Tesla Inc.’s billionaire founder Elon Musk said that the electric car maker would be open to talks about a friendly merger with a rival vehicle maker. Shares dropped 4.3% to $559.50 in Wednesday’s pre-market trading.

At an Axel Springer event in Berlin, where Musk received an award, he was asked by CEO Mathias Döpfner if it was a serious option for Tesla (TSLA) to buy one of the big car companies.

“We are definitely not going to launch a hostile takeover. If somebody said it would be a good idea to merge with Tesla, we would certainly have this conversation,” Musk said in response, but didn’t disclose any ongoing discussions about any merger or acquisition.

Tesla’s market capitalization has recently hit the $500 billion mark as the stock exploded almost 600% this year. Last month, it was announced that TSLA will finally join the S&P 500 benchmark index on December 21. The inclusion will place it among the most valuable companies on the S&P 500.

The electric vehicle maker has goal of delivering 500,000 cars in 2020. “Achieving this target depends primarily on quarter over quarter increases in Model Y and Shanghai production, as well as further improvements in logistics and delivery efficiency at higher volume levels,” the company said back in October.

So, what’s next for Tesla? In an email to employees seen by Electrek, Musk laid out the importance for the automaker to focus on profits and cost-saving in view of the stock’s high valuation.

“When looking at our actual profitability, it is very low at around 1% for the past year. Investors are giving us a lot of credit for future profits, but if, at any point, they conclude that’s not going to happen, our stock will immediately get crushed like a soufflé under a sledgehammer!” Musk wrote in the e-mail.

“Much more important, in order to make our cars affordable, we have to get smarter about how we spend money. This a tough Game of Pennies – requiring thousands of good ideas to improve part cost, a factory process or simply the design, while increasing quality and capabilities. A great idea would be on that saves $5, but the vast majority are 50 cents here or 20 cents there,” he stated.

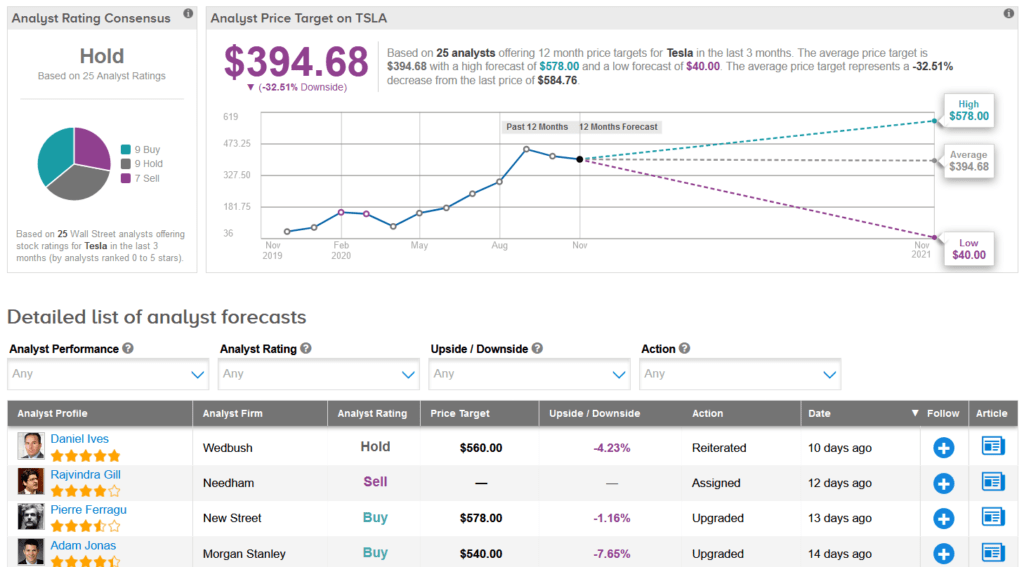

This year’s rally has left Wall Street analysts sidelined on the stock. The Hold analyst consensus breaks down into 9 Holds, 7 Sells and 9 Buys. That’s with an average price target of $ 394.68, implying 33% downside potential lies ahead over the coming 12 months.

Meanwhile, Wedbush analyst Daniel Ives raised his bull-case price target by 25% arguing that, in the best case scenario, TSLA could hit $1,000 a share by the end of 2021, as demand for electric vehicles “inflects” on a global scale. In a base case scenario, the analyst sets the price target at $560 a share (4% downside potential) and for now maintains a Hold rating.

“With the sustained path to profitability and S&P 500 index inclusion achieved, the Tesla bull story is now all about a stepped up EV demand trajectory into 2021,” Ives wrote in a note to investors. (See TSLA stock analysis on TipRanks)

By 2025, Ives believes that 1 car in 10 sold will be an EV. And because Tesla is the “EV category leader,” it makes sense to assume that many of these EVs sold over the next five years will be Teslas.

Related News:

JinkoSolar Divests 50% Stake In Sweihan Power Station; Street Sees 42% Downside

Spain’s BBVA And Sabadell Call Off Merger Talks; Shares Sink 13%

Tesla Steps Up Plan To Produce Electric Car Chargers In China – Report