Tesla Inc.’s (TSLA) vehicle registrations in California almost halved in the second quarter of the year, Reuters reported, citing data from Cross-Sell, a marketing research firm that collates title and registration data.

Shares were trading down 5.4% at $1,463 in Thursday’s pre-market trading. The data showed registrations in California, a bellwether market for the electric-car maker, plunged almost 48% from a year earlier to 9,774 vehicles in the three months ended June 2020.

During the reported period between April and June, most parts of the U.S. were under government-imposed stay-at-home orders to slow the spread of the coronavirus outbreak, which impacted production and caused a plunge in auto sales.

Tesla’s only U.S. vehicle factory in California was closed for more than six weeks with production disrupted from the end of March to early May.

In the second quarter, Model 3 registrations in the state, which accounted for more than half of the total registrations, dropped 63.6% to 5,951 vehicles. Total vehicle registrations in the 23 states from where the data was collected fell nearly 49% to 18,702 vehicles. Registration figures might not accurately reflect the number of vehicle deliveries during the quarter as registrations in the U.S. typically take about 30 days from the time of sale.

Tesla stock has this month already gained 43% as the carmaker reported 90,650 car deliveries in the second quarter, which exceeded analysts’ expectations for about 74,130 vehicles.

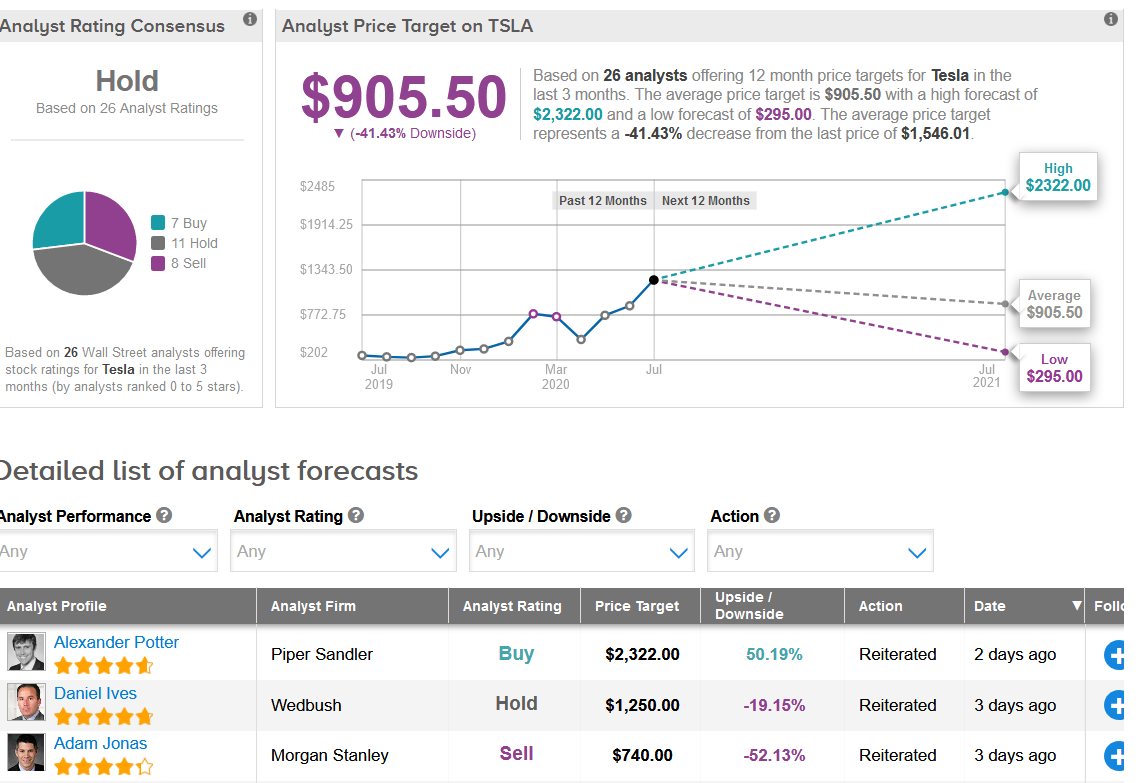

Barclays analyst Brian Johnson who has a Hold rating on Tesla with a $300 price target (81% downside potential) believes the stock is overvalued but has more room to run, and therefore recommends “bearish friends to remain in the shelter of their caves”.

Commenting on Tesla’s second-quarter car deliveries report, Johnson said that the carmaker “beat a low bar for deliveries (90.6k actual, vs. 70k consensus, we were at 85k), leading to a massive two-day run in the shares.”

“We were above consensus on earnings going into deliveries with the additional 5k deliveries we now forecast $42.0mn GAAP profit – enough to qualify for S&P 500 inclusion,” Johnson wrote in a note to investors. “As a result, while we still believe TSLA is fundamentally overvalued, we see nothing to prevent the shares moving higher in the coming weeks.”

Looking ahead, five-star analyst Daniel Ives at Wedbush says that although investors will be focusing next on 2Q earnings on July 22, he continues to believe that Battery Day now to be held on Sept. 22 will be a major positive catalyst for the stock.

The analyst though maintained a Hold rating on the stock with a $1,250 price target for the base case and a $2,000 price target for the bull case. In line with Johnson’s and Ives’ rating outlook, the majority of Wall Street analysts are sidelined on the stock with a Hold analyst consensus.

In light of this year’s strong rally, the $905.50 average analyst price target now implies 41% downside potential for the shares in the coming 12 months. (See Tesla’s stock analysis on TipRanks).

Related News:

Tesla Wins Tax Breaks For Potential Vehicle Factory In Texas; Barclays Says Stock ‘Overvalued’

Tesla Climbs 6% In Pre-Market, Boosted By ‘Accelerating’ China Projects

Tesla’s Elon Musk Overtakes Buffett On Billionaires Rich List