Telia announced on Tuesday that it has reached an agreement to sell its international carrier unit, Telia Carrier, to Swedish pension fund Polhem Infra in a cash deal valued at SEK 9.45 billion ($1.06 billion).

Stockholm-based mobile operator Telia (TLSNF) said that as a result of the cash infusion and recent disposals, including the shareholding in Turkcell, its board of directors has proposed to reinstate a dividend which was shelved due to the Covid-19 crisis. The Board of Directors has decided to propose to pay an additional dividend of SEK 0.65 per share, subject to the approval by an Extraordinary General Meeting.

If approved, the resulting total dividend per share payment would amount to SEK 2.45 for the financial year 2019, which is the dividend level which was originally announced in January this year and equates to 80% of operating free cash flow.

“The divestment of Telia Carrier highlights the value Telia has built in its digital infrastructure – and today we are able to crystallize some of that value. As a consequence, we can now fully concentrate on our Nordic and Baltic footprint,” said Telia CEO Allison Kirkby. “The majority of the proceeds from the sale will be used to strengthen our balance sheet, enabling both investments in services and networks in our core markets as well as providing a strong foundation for attractive shareholder remuneration.”

As part of the divestment agreement, Telia entered a long-term strategic partnership with Telia Carrier, to secure its customers future access to the carrier’s solutions and services.

The acquisition is Polhem’s first investment in digital infrastructure. Polhem is jointly owned by the Swedish Pension Funds; First AP Fund, Third AP Fund and Fourth AP Fund.

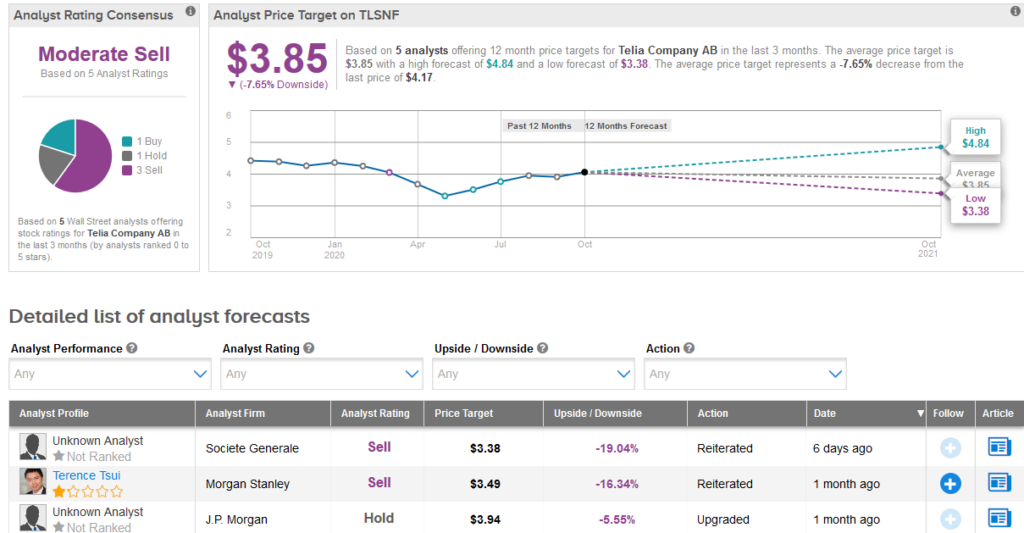

Shares in Telia have trimmed most of their losses after reaching a low in April and are now trading 3.5% lower than at the stock of the year. That’s with a Moderate Sell analyst consensus which breaks down into 3 Sells, 1 Hold and 1 Buy. (See Telia stock analysis on TipRanks)

Looking ahead, the $3.85 average analyst price target implies 7.7% downside potential over the coming year.

Related News:

Exxon To Axe 1,600 Workers in Europe; Merrill Lynch Says Buy

Northern Star, Saracen To Merge To Create $11.5B Gold Miner

Targa Up 6% On $500M Buyback Plan, Strong Outlook; Analyst Sees 82% Upside