Shares of the multinational telemedicine and virtual healthcare firm Teladoc Health, Inc. (TDOC), plunged 7.4% in pre-market trading on Wednesday after the company delivered a worse-than-feared second-quarter loss.

The company reported an adjusted loss of $0.86 per share, worse than the analysts’ expectations of a loss of $0.56 per share. The company reported a loss of $0.34 per share in the prior-year period.

However, total revenue grew 109% year-over-year to $503 million versus the consensus estimate of $500.7 million. The increase in revenues was due to a surge in Access Fees, which increased 138% to $434 million. (See Teladoc stock charts on TipRanks)

Teladoc Health CEO Jason Gorevic commented, “We have solid momentum heading into the second half as the market embraces the unified care experience that only Teladoc Health has the breadth and scale to achieve.”

Updated Guidance

Based on solid Q2 revenue growth, the company raised its full-year guidance. Revenues are forecast to be in the range of $2 – $2.025 billion, versus the consensus estimate of $2.01 billion. The company forecasts an adjusted loss in the range of $3.60 to $3.35 per share, while the consensus estimate is pegged at a loss of $2.75 per share.

For the third quarter, revenues are projected to be in the range of $510 – $520 million, versus analysts’ expectations of $514.4 million. Adjusted losses are likely to range between $0.78 and $0.68 per share, while the consensus estimate is pegged at a loss of $0.50 per share.

Following the Q2 results, Piper Sandler analyst Sean Wieland reiterated a Buy rating on the stock with the price target of $291 (92.7% upside potential).

Wieland forecast that the company will undergo a “fundamental transformation” over the next five years from fee-for-service to value-based care model.

Overall, the stock has a Moderate Buy consensus rating based on 10 Buys and 10 Holds. The average Teladoc price target of $204.60 implies 35.5% upside potential from current levels.

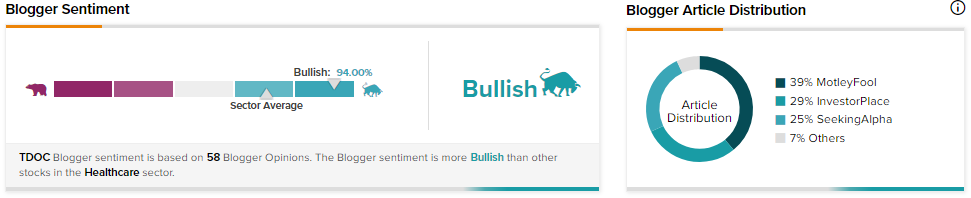

TipRanks data shows that financial blogger opinions are 94% Bullish on Alphabet, compared to a sector average of 71%.

Related News:

Calix Delivers Upbeat Q2 Results; Shares Rise

Range Resources Posts Mixed Q2 Results; Shares Drop 3.1%

Brown & Brown Posts Upbeat Results in Q2