Canadian-based miner Teck Resources (NYSE:TECK) is in advanced talks to sell its coal assets to British miner Glencore (OTCMKTS:GLCNF). As per a Wall Street Journal report, the assets are valued at roughly $10 billion, making it one of the biggest mining deals this year. The companies may provide more updates on the deal this week.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Teck Resources produces metallurgical coal which is used in making steel.

Teck has been contemplating offloading its coal business for quite some time now. Earlier this year, it planned to split the company into two; one focused on base metals and the other on coal. Further, both Teck and Glencore had planned on merging their businesses for a deal valued at close to $22.5 billion earlier this year. The combined entity would then spin off the coal business into a standalone unit. But all the preliminary talks fell apart as Teck worried that Glencore’s oil and coal operations would have violated Teck’s own Environmental, Social, and Governance (ESG) values.

It remains to be seen if the two parties agree to the terms of the new deal and go ahead with it.

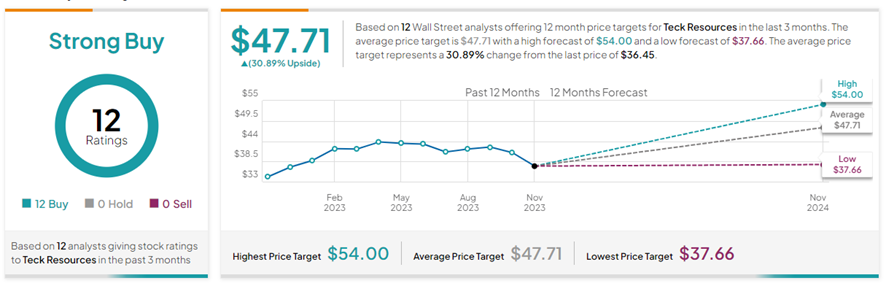

What is the Future of Teck Stock?

Yesterday, Stifel Nicolaus analyst Alex Terentiew reiterated a Buy view on TECK stock and set the price target to $51.42 (41.1% upside potential).

Overall, with 12 unanimous Buy ratings, TECK stock commands a Strong Buy consensus rating on TipRanks. Also, the average Teck Resources Class B price target of $47.71 implies 30.9% upside potential from current levels. TECK stock has gained 1.3% so far this year.

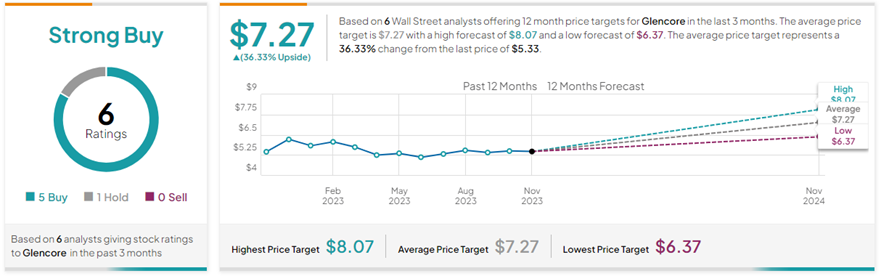

Is Glencore Stock a Buy?

On November 13, HSBC analyst Shilan Modi cut the price target on GLCNF stock to $5.75 (7.9% upside) and maintained a Hold rating.

The other five analysts who recently rated Glencore have given the stock a Buy rating. Based on these, Glencore has a Strong Buy consensus rating on TipRanks. The average Glencore price forecast of $7.27 implies 36.3% upside potential from current levels. Year-to-date, GLCNF stock has lost 10.3%.