Taylor Wimpey (GB:TW) on Wednesday posted its half-yearly results for 2022 – with profit before tax jumping by 16.3% to £334.5 million amid surging demand for homes.

Revenues were down by 5.4% from last year but still ahead of guidance numbers.

The outlook remains strong as private completions are already 92% forward sold. The company faces some challenges with rising building costs, but that could be offset by higher home prices.

The numbers are on track

Taylor Wimpey completed around 6,790 homes in the first half, which is ahead of expectations, although the number is lower than the 7,219 homes completed in the first half of 2021.

The company’s operating profit was flat at £424.6 million, but its operating margin jumped by 1.1 points to 20.4%. The company benefitted from rising house prices, some high-margin land sales, and joint venture profits.

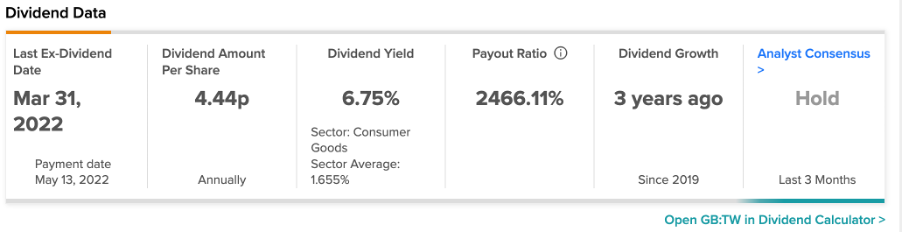

The company didn’t forget about its shareholders and announced an interim dividend of 4.62p per share, worth £163 million. It has a dividend yield of 6.75% as compared to the sector average of 1.6%.

The company expects its operating profit to be on the higher side of the guidance range. It is also on track towards achieving its margin of 21-22% on a year-over-year basis.

Share prices are off track

The company has made good progress in its operations after the slowdown caused by the pandemic. It also rewarded the shareholders well but the share prices do not look to be in sync with that. The stock is trading down by 20% in the last year.

In the wake of results, the share prices jumped by 4.3%, as the company is confident about growing demand for houses.

View from the City

According to TipRanks’ analyst rating consensus, Taylor Wimpey stock has a Hold rating. The stock has one Buy and one Sell rating.

The average price target is 146.5p, which is 16% higher than the current price level. The stock has a high forecast of 189p and a low forecast of 104p.

Conclusion

The UK housing market is witnessing a demand-supply imbalance. The aspiration to own a house is high among customers. If the company is able to manage its supply and manage costs, the full-year results should be cheering for investors.