Shares of Target Corp. jumped over 12% after the retailer crushed 2Q analysts’ estimates spurred by record digital comparable sales during the coronavirus pandemic.

Target’s (TGT) second-quarter adjusted earnings of $3.38 per share surpassed Street estimates of $1.63. Its revenues of around $23 billion were also ahead of analysts’ expectations of about $20 billion. Both earnings and revenues surged by 85.7% and 24.8%, respectively, on a year-over-year basis.

Target reported comparable sales growth of 24.3% in 2Q, with digital comparable sales growth of 195%. The company added 10 million new digital customers in the first six months of the year.

“Despite the volatility in early August, August sales comps have been running in the low double digits, which shows we are sustaining relevance and the trust we built quarter-after quarter,” Target’s CEO Brian Cornell said.

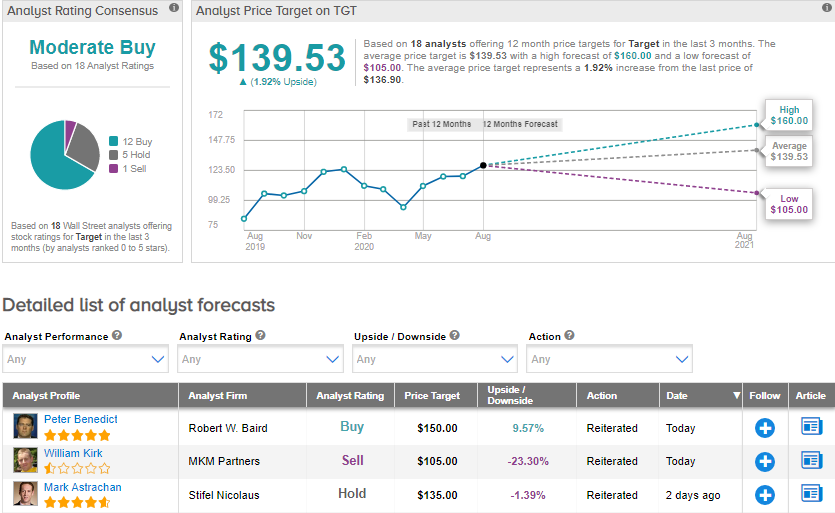

Following the 2Q results, Robert W. Baird analyst Peter Benedict maintained a Buy rating on the stock with a price target of $150 (9.6% upside potential). Benedict noted the “blowout performance” in 2Q and said that “the 100% earnings beat was driven by better comps, gross margins, and expense leverage.” The analyst added that the “momentum continued into August and stores fulfilled more than 90% of Q2 sales.”

Currently, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 12 Buys, 5 Holds, and 1 Sell. The average price target of $139.53 implies upside potential of about 1.9%. (See TGT stock analysis on TipRanks).

Related News:

Lowe’s Delivers Blowout Q2 As Online Sales Surge 135%

Walmart vs Target: Which Retailer is the Better Buy?

Target Ramps Up Dividend By 3%