Shares of Target Corporation (TGT) dropped 3.2% in Wednesday’s early trading session, even though the company posted stronger-than-expected Q3 results. Target’s stores offer food products and general merchandise across all U.S. states and the District of Columbia.

Quarterly revenues stood at $25.7 billion, up 13.3% from the last year’s quarter. Also, it surpassed the consensus estimate of $24.8 billion.

While Store comparable sales rose 9.7%, Digital comparable sales went up 29%. Further, over 95% of Target’s Q3 sales were fulfilled by its stores.

The company reported adjusted earnings per share (EPS) of $3.03, which compares favorably with $2.79 per share in the same quarter last year. Also, the figure came ahead of the Street’s estimate of $2.83 per share. (See Target stock chart on TipRanks)

The Chairman and CEO of Target, Brian Cornell, said, “With a strong inventory position heading into the peak of the holiday season, our team and our business are ready to serve our guests and poised to deliver continued, strong growth, through the holiday season and beyond.”

Guidance

For the fourth quarter of 2021, the company expects comparable sales growth in high single-digit to low-double-digit. Target continues to expect its full-year operating income margin rate to be 8% or higher.

See Analysts’ Top Stocks on TipRanks >>

Stock Rating

Based on 12 Buys and 5 Holds, the stock has a Moderate Buy consensus rating. The average Target price target of $286 implies 7.4% upside potential from current levels. Shares have gained 5% over the past month.

Website Traffic

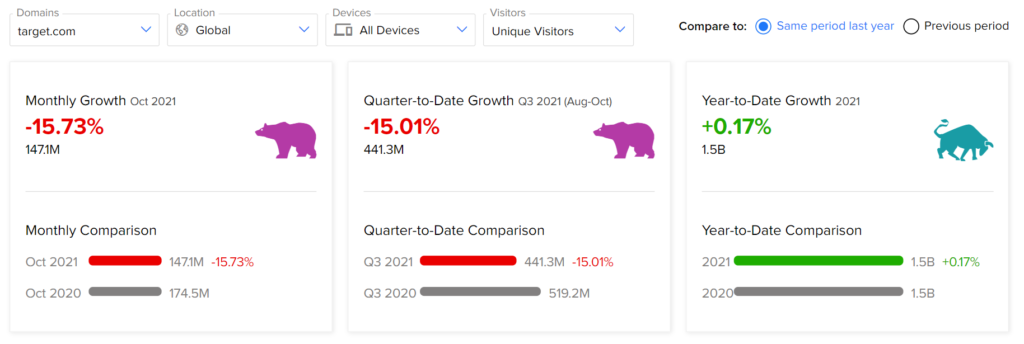

TipRanks’ Website Traffic tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into Target’s performance.

The Target website traffic recorded a 15.7% monthly decrease in visits in October against the same quarter last year. Meanwhile, the website traffic has grown 0.2% year-to-date.

Related News:

Realty Income Hikes Monthly Dividend by 5.1%

Atea Drop 11.4% on Terminating Collaboration with Roche

Boeing Expansion Continues with New Orders