Targa Resources Corp. (TRGP) has agreed to acquire Southcross Energy and its subsidiaries in South Texas for $200 million.

Targa, a FORTUNE 500 company, provides midstream services and is one of the biggest midstream infra companies in the North American region.

Deal Highlights

Targa is acquiring Southcross at about 4x its adjusted EBITDA. The move offers potential for further synergies to reduce acquisition multiples over time.

Additionally, the transaction also provides the potential to move an idle plant with a capacity of 200 million cubic feet per day. The acquisition provides Targa fee-based contracts where a majority of volumes are low-pressure wellhead gathering.

The transaction is anticipated to close in Q2 2022. Wells Fargo is the financial advisor for Targa on the acquisition.

Analysts’ Take

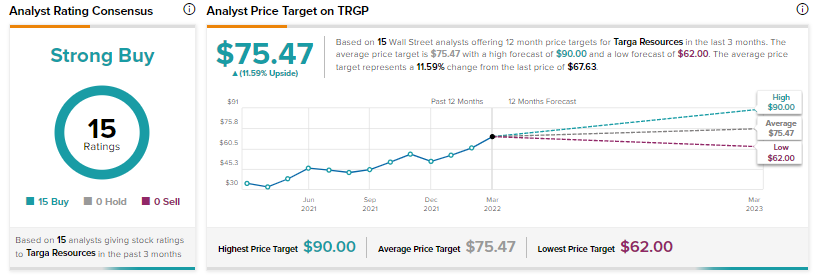

Recently, J.P. Morgan analyst Jeremy Tonet reiterated a Buy rating on Targa alongside a price target of $90.

Overall, the Street has a Strong Buy Consensus rating on Targa based on 15 unanimous Buys. The average Targa Resources price target of $75.47 implies upside potential of 11.6% over the next 12 months.

Valuation Metrics

Now let’s have a look at some of the key metrics for Targa and how it fares against the broader industry. Targa has an EBITDA margin of 13%, which is lower than the industry median of 24.8%, indicating that the company could streamline operations to drive margins.

Importantly, Targa generates $29.3K in net income per employee, whereas the sector median figure is $71.6K, indicating Targa’s peers are superior in utilizing their workforce.

On the other hand, Targa’s return on total capital of 6.2% is ahead of the industry median of 4.4%, indicating that the company is more efficient at deploying its capital.

Further, the forward non-GAAP P/E multiple for Targa is at 18.9, while the sector median is 9.4, indicating Targa’s current share price is on the expensive side versus its industry peers. Shares are up 27% so far this year.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Ford to Expand EV Footprint in Europe

ExxonMobil Fails to Rescind Appeal to Terminate Climate Change Investigations

Intel to Invest €80B to Expand Footprint in European Union