Global kitchen and laundry equipment provider Whirlpool (WHR) recently delivered a mixed set of Q3 numbers, and upped its fiscal 2021 outlook.

Let’s have a look at Whirlpool’s Q3 financials, as well as what has changed in its key risk factors that investors should know.

Boosted by cost-based pricing actions and robust consumer demand, revenue increased 3.7% year-over-year to $5.5 billion, but lagged estimates by $231 million.

The company expects its brand portfolio and product pipeline to help it capitalize on strong demand in housing, higher appliance usage, e-commerce, and D2C. Additionally, a low fixed-cost base positions Whirlpool well to achieve margin expansion and increase profitability.

Furthermore, the net earnings margin of the company expanded by 120 basis points to 8.6%. Earnings per share at $6.68 outperformed analysts’ estimates by $0.53. (See Insiders’ Hot Stocks on TipRanks)

Looking ahead, whirlpool upped its annual organic sales guidance growth to 5%-6% versus an earlier estimate of 3%. ROIC is estimated to hover between 15%-16%, as compared to 12%-14% previously.

Marc Bitzer, Chairman, and CEO of Whirlpool commented, “We are announcing our increased long-term value creation targets as well as increasing our earnings per share guidance to ~$26.25. We have, and we will continue to deliver strong performance in a challenging environment.”

Shares are up 19.3% so far this year.

Risk Factors

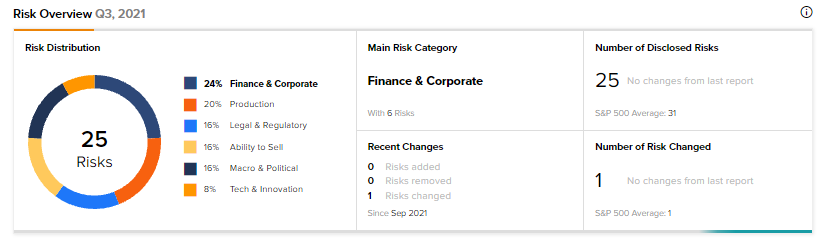

According to the new TipRanks Risk Factors tool, Whirlpool’s main risk category is Finance & Corporate, accounting for 24% of the total 25 risks identified. In the recent Q3 report, the company changed one key risk factor under the Production risk category.

Whirlpool noted that it uses a range of materials and components in the production of its global products. Some key parts may be available from a single or small number of suppliers which exposes Whirlpool to supply and pricing risks.

Additionally, COVID-19 induced supply chain disruptions, raw material shortages, and cost inflation could also impact the company.

The sector average Finance & Corporate risk factor is 40%.

Related News:

Qualtrics International Beats Q3 Expectations and Raises FY2021 Outlook

Cambium Networks Lowers Q3 Guidance; Shares Plunge 16.1%

BJ’s Restaurants Posts Weak Third Quarter Results