Shares of Snowflake Inc. (NYSE: SNOW) have surged 45% over the past 6 months. The cloud-based data platform provider recently posted a mixed set of performance for the third quarter, with its top-line exceeding estimates and its bottom-line falling short of estimates.

Notably, the 110% growth in its top-line came from higher product revenue coupled with triple-digit growth in Europe, the Middle East and Africa (EMEA), and the Asia Pacific and Japan (APJ) regions.

With these developments in mind, let us take a look at the changes in Snowflake’s key risk factors that investors should know.

Risk Factors

According to the TipRanks Risk Factors tool, Snowflake’s stock top risk category is Finance & Corporate, contributing 43% to the total 46 risks identified. Compared to a sector average of 40%, Snowflake’s Finance & Corporate risk factor is at 43%.

In the recent quarterly report, the company has changed three key risk factors, and the first two fall under the Finance & Corporate risk category.

Snowflake noted that its share price and trading volume are influenced by analysts’ interpretations of the company’s financial information and other disclosures. If analysts stop coverage of Snowflake, do not publish reports about its business, downgrade its stock, or publish negative reports about the company, then Snowflake’s share price could suffer.

Similarly, Snowflake highlighted that its business model is consumption-based and not subscription-based. While subscription-based models recognize revenue ratably over the term of the subscription, Snowflake usually recognizes revenue on consumption. (See Insiders’ Hot Stocks on TipRanks)

Consequently, Snowflake may not have visibility into its future financial position and results of operations. If the company’s results fall below the expectations of investors and analysts, then its share price may take a hit.

Meanwhile, under the Macro & Political risk category, Snowflake highlighted that the present COVID-19 pandemic could have an adverse impact on the company’s business, and operations. The potentially long-term impact and duration of the pandemic and its new variants on the global economy and Snowflake, in particular, remain difficult to gauge.

Wall Street’s Take

On December 6, Credit Suisse analyst Philip Winslow reiterated a Buy rating on the stock and increased the price target to $465 from $455 (28% upside potential).

The analyst views Snowflake’s revenue acceleration and margin gains positively, and adds that the company will have an increasingly critical role in the data value chain.

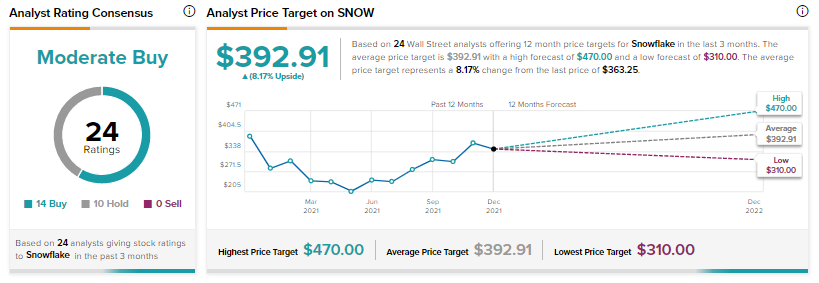

Consensus on the Street is a Moderate Buy based on 14 Buys and 10 Holds for the stock. The average Snowflake price target of $392.91 implies a potential upside of 8.17% for the stock.

Related News:

Kohl’s Shares Up as Investor Urges Business Split

Spotify Removes Comedians Work Amid Royalty Dispute

Big Lots Posts Better-Than-Expected Q3 Results; Shares Up 5%