Galaxy Next Generation, Inc. (GAXY) provides interactive learning technology solutions. Its products comprise the company’s own private-label interactive touch screen panel and other national and international branded peripheral and communication devices.

Let’s take a look at the company’s financials and understand what has changed in its key risk factors that investors should know.

GAXY’s fourth-quarter 2021 revenue increased 117% year-over-year to $1.02 million on the back of a rise in customer base.

The CFO of GAXY, Magen McGahee, said, “All of our key performance indicators continue to trend in the right direction. Our balance sheet has strengthened with increases in cash and assets and decreases in stockholders’ deficit and liabilities. Not only did our revenue increase by 117% for the quarter and 63% for the year, but our backlog and orders remain strong.”

The company’s gross profit increased 34% year-over-year to $0.6 million. The expanded gross profit and higher revenue helped GAXY narrow its net loss to $0.6 million, as compared to a net loss of $3.9 million a year ago. (See Galaxy Next Generation stock chart on TipRanks)

Shares are down 66% over the past six months.

Now, let’s look at what’s changed in the company’s key risk factors.

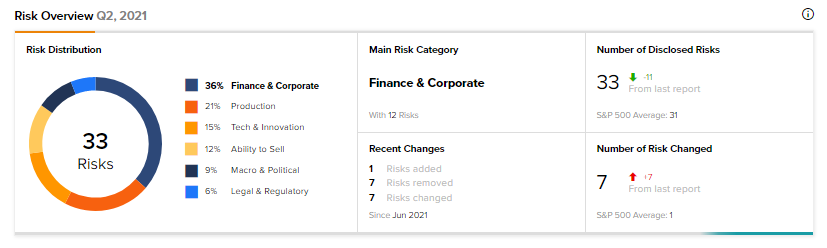

According to the new Tipranks’ Risk Factors tool, GAXY’s main risk category is Finance & Corporate, which accounts for 36% of the total 33 risks identified. Since June, the company has added one key risk factor under the Production risk category.

GAXY acknowledges that it relies on third-party manufacturers and if they do not perform satisfactorily then GAXY’s business may be harmed. The company stated that it may not be able to meet the demand for its products and lose potential revenue if its contract manufacturers fail to deliver the required components on a timely basis or at reasonable prices. In such an event, it may also take GAXY substantial time to establish an alternative source of supply for its components.

The Production risk factor’s sector average is at 12%, compared to GAXY’s 21%.

Related News:

J.P. Morgan to Provide Card Payment Processing Services for Alibaba.com in U.S.

Nokia to Launch 5G Network in Indonesia with Indosat Ooredoo

Repligen Inks $150M Deal to Buy Avitide