ESCO Technologies Inc. (ESE) recently delivered better-than-estimated performance for the fourth quarter, driven by cost structure optimization, cash flow management, and program execution.

The better-than-expected top-line was attributable to higher Utility Solutions Group (USG) and Test segment revenue performance. The company provides engineered products and systems catering to aviation, navy, space, defense, industrial and process markets globally.

With this backdrop in mind, let us take a look at the changes in ESCO’s key risk factors that investors should know.

Risk Factors

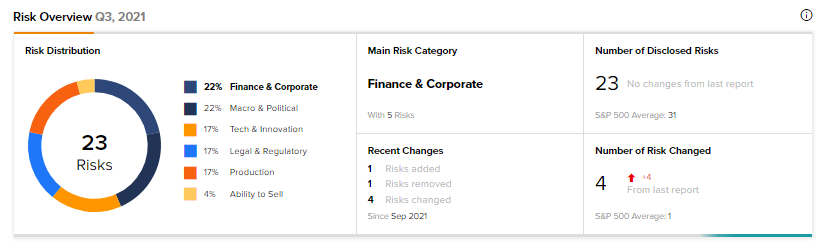

According to the TipRanks Risk Factors tool, ESCO’s top two risk categories are Finance & Corporate and Macro & Political, contributing 22% each to the total 23 risks identified. In its recent annual report, the company has added and done away with one key risk factor each.

Under the Tech & Innovation risk category, ESCO highlighted the risks from cyber threats to its systems. Any disruptions to ESCO’s IT systems, IT security, or a breach of data privacy could adversely impact its business.

(See Insiders’ Hot Stocks on TipRanks)

Furthermore, any losses stemming from such issues may be covered by information security insurance. However, ESCO noted that it cannot guarantee that its coverage would be enough to cover all costs or losses incurred during such an event.

ESCO removed a risk under the Production risk category. It acknowledged that a significant portion of its Test segment business involves working with general contractors to produce complex building components constructed on-site.

Any performance-related problems could result in cost overruns for ESCO. Additionally, any disputes with contractors could result in adverse impact to the company’s Test segment results, loss of a particular project, or damages awarded against ESCO.

Compared to a sector average of 9%, Macro & Political risk factor ESCO’s is at 22%.

Wall Street’s Take

Two months ago, Sidoti analyst John Franzreb upgraded the stock to a Buy from Hold with a price target of $99 for the stock (19.3% upside potential). However, shares have dropped 17% so far this year.

ESCO scores a 4 out of 10 from TipRanks’ Smart Score rating system, indicating that the stock is likely to perform in line with the broader market.

Related News:

Goldman Sachs Launches Financial Cloud Offering with AWS

Nasdaq and AWS Collaborate to Transform Capital Markets

Amazon to Invest in 18 New Renewable Energy Projects