Analytics automation company Alteryx, Inc. (AYX) delivered better-than-estimated Q2 results on August 3. Its end-to-end platform brings together analytics, data science and business process automation, helping in the accelerated digital transformation of organizations across the globe.

Let’s take a look at the financial performance of the company and see what has changed in its key risk factors that investors should know.

On the back of higher subscription and PCS & services revenue, Alteryx’s Q2 revenue jumped 25% year-over-year to $120.1 million, beating consensus by $7.3 million. Notably, Alteryx increased its number of customers by 10% to 7,405 and notched a 120% dollar-based net expansion rate (annual contract value-based) during the second quarter.

The CEO of Alteryx, Mark Anderson, said, “Alteryx continues to make meaningful progress on our transformation journey as evidenced by our ARR (Annual Recurring Revenue) growth of 27% this quarter. We also see significant momentum with our go-to-market strategy under our new Chief Revenue Officer, Paula Hansen.”

Net loss per share at $0.08 was narrower than analysts’ estimates by $0.17. Looking ahead, Alteryx expects Q3 revenue to be between $121 million and $124 million. It sees a net loss per share between $0.21 and $0.18. (See Alteryx stock chart on TipRanks)

On August 4, Citigroup analyst Tyler Radke reiterated a Buy rating on the stock but lowered the price target to $125 from $136.

Radke said, “Alteryx saw a recovery in new business trends in Q2 but its outlook was more complicated with annual recurring revenue guidance maintained but revenue guidance cut on lower contract duration.”

Based on 11 Buys and 2 Holds, consensus on the Street is a Strong Buy. The average Alteryx price target of $112.17 implies 51.1% upside potential. Shares of the company have dropped 33.2% so far this year.

Now, let’s look at what has changed in the company’s key risk factors.

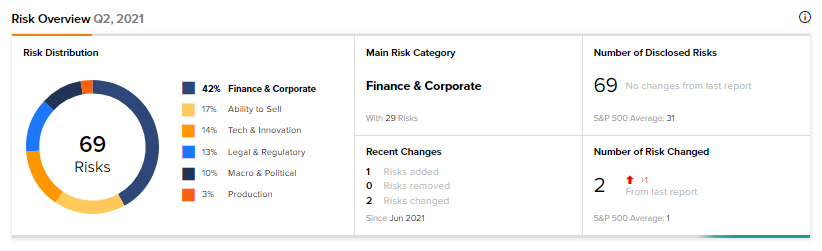

According to the new Tipranks’ Risk Factors tool, Alteryx’s main risk category is Finance & Corporate, which accounts for 42% of the total 69 risks identified. Since June, the company has added one key risk factor under the Legal & Regulatory category.

In the current environment of increased scrutiny of industry’s actions and views on a range of topics like climate change, global warming and diversity, Alteryx notes that positions it may take or choose not to take on social and ethical issues may be unpopular with some of its employees, partners, or customers, which may impact its ability to attract talent, partners, or customers.

Alteryx notes that any failure in addressing progress related to environmental, social, and governance (ESG), and any related initiatives, and commitment to a diverse board and workforce may attract the attention of the investment community, which could adversely impact its reputation, business, and financial performance.

The Finance & Corporate risk factor’s sector average is at 38%, compared to Alteryx’s 42%.

Related News:

Jamieson Wellness Q2 Profit Up 22%, Dividend Rises

TMX Group’s Q2 Profit Beats Estimates; Shares Rise 6%

Quebecor’s Q2 Profit Down 29%; Shares Fall 5%