The provider of photovoltaic solar energy generation systems, SunPower (NASDAQ: SPWR) declined in pre-market trading on Wednesday after the company announced that it plans to restate its financial statements for FY 2022 and for the first and second quarter of FY23.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The company stated in its press release that it was restating these financial statements as it had determined that the “value of consignment inventory of microinverter components at certain third-party locations had been overstated in the Affected Periods in the range of approximately $16 million to $20

million, resulting in the associated cost of revenue being understated.”

SunPower added that it has yet to complete the review of its financial statements and as a result the financial impact of these errors could be “subject to change.” The company expects to announce its Q3 results on November 1.

Is SPWR Stock a Good Buy?

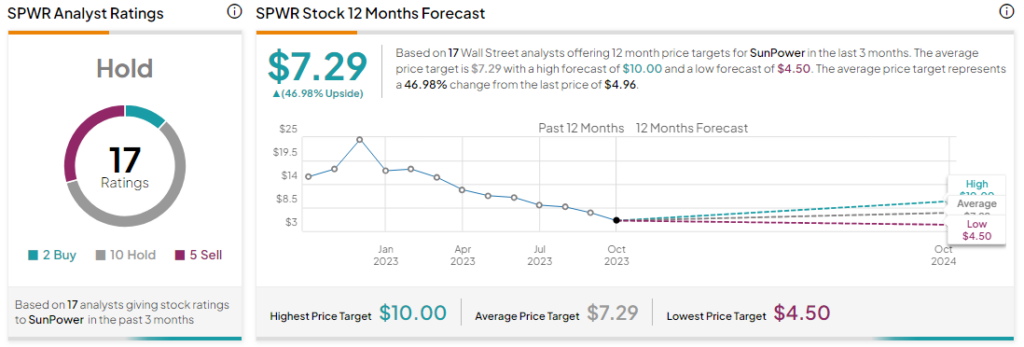

Analysts remain sidelined about SPWR stock with a Hold consensus rating based on two Buys, 10 Holds and five Sells. The average SPWR price target is $7.29 implying an upside potential of around 47% at current levels.