Cloud-based machine data analytics provider Sumo Logic, Inc. (SUMO) recently delivered better-than-estimated performance for the third quarter, driven by continued adoption of its Continuous Intelligence platform.

During the quarter, SUMO’s net loss per share widened over the prior year, yet excededed expectations. Additionally, SUMO has appointed Stewart Grierson as CFO.

With these developments in mind, let’ us take a look at the changes in SUMO’s key risk factors that investors should know.

Risk Factors

According to the TipRanks Risk Factors tool, SUMO’s top two risk categories are Finance & Corporate and Ability to Sell, contributing 42% and 17% to the total 66 risks identified, respectively. Compared to a sector average of 14%, SUMO’s Ability to Sell risk factor is at 17%.

In its recent quarterly report, the company has added one key risk factor under the Tech & Innovation risk category.

SUMO noted that with its recent acquisition of Sensu, it will intentionally make Sensu Go (one of its offerings) freely available under an open-source licensing model. (See Insiders’ Hot Stocks on TipRanks)

This open license version will be complemented by paid versions of Sensu, making use of a business strategy called an open-core licensing model. This strategy is employed to spur the adoption of paid offerings, with additional features or commercial benefits.

However, open-source editions generally have very low conversion rates, and the company may not be able to convert users to customers at the required rate.

If SUMO decides to cease support of the open-source edition later on, then it could result in criticism, negative public relations, while also reducing the popularity of the company’s paid offerings.

Wall Street’s Take

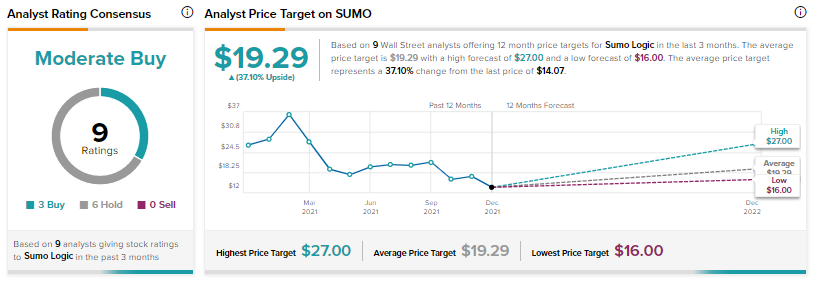

On December 7, Rosenblatt Securities analyst Blair Abernathy reiterated a Buy rating on the stock alongside a price target of $27 (92% upside potential).

Consensus on the Street is a Moderate Buy based on 3 Buys and 6 Holds for the stock. The average Sumo Logic price target of $19.29 implies a potential upside of 37.1%. Shares are down 29.2% over the past six months.

Related News:

Meta Platforms Buys Name Rights for Meta

Bristol Myers Squibb Rewards Shareholders; Shares Up 4.8%

Abbott Rewards Shareholders; Shares Record New All-Time High