Last Updated 4:05 PM EST

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Stock indices finished today’s trading session in the red amid soft economic data (see updates below). The Nasdaq 100 (NDX), the S&P 500 (SPX), and the Dow Jones Industrial Average (DJIA) fell 1.51%, 1.47%, and 1.14%, respectively.

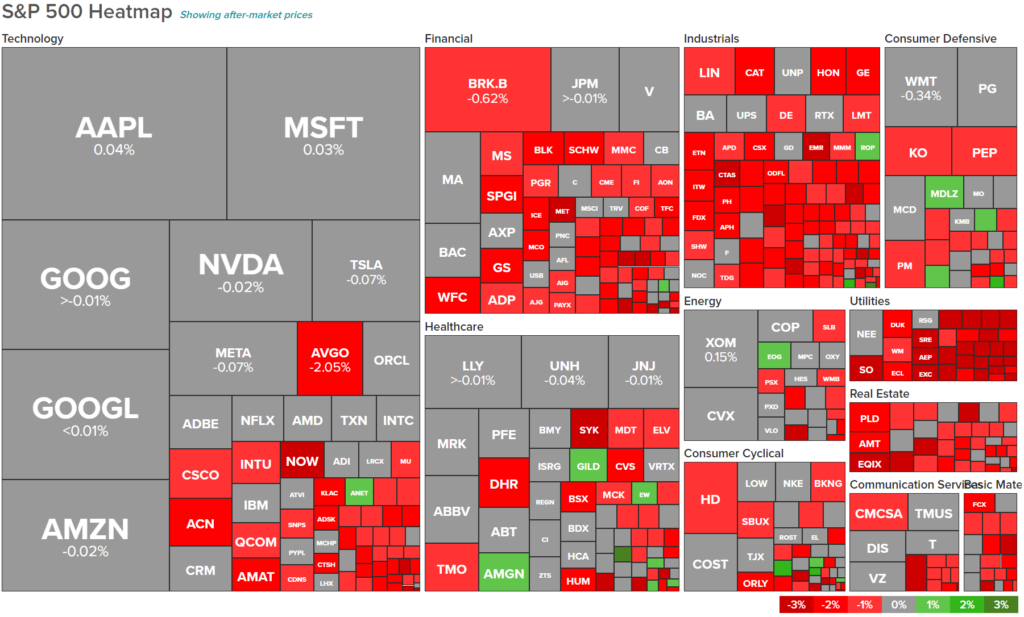

The utilities sector (XLU) was the session’s laggard, as it fell 3.01%. Conversely, the energy sector (XLE) was the session’s leader but still fell by 0.59%. Indeed, a quick look at a heatmap for the S&P 500 shows very little green among the different sectors.

Furthermore, the U.S. 10-Year Treasury yield increased to 4.55% while the Two-Year Treasury yield remained flat, as it hovers around 5.13%.

Last updated: 2:30PM EST

Stock indices are in the red so far in today’s trading session. On Tuesday, the Conference Board released its Consumer Confidence report, which, as the name suggests, measures the consumers’ confidence in the economy. This report is believed to be a leading indicator for spending patterns as optimistic consumers are more likely to spend as opposed to pessimistic ones.

For September, consumer confidence came in at 103, which was lower than expectations of 105.5. This was also lower than last month’s reading of 108.7. In addition, compared to September 2022, sentiment declined by 4.4% on a year-over-year basis.

Last updated: 12:00PM EST

Earlier today, the Census Bureau released its United States New Home Sales data for August, which came in at 675,000. For reference, forecasters were expecting a print of 700,000. This was also lower than last month’s report of 739,000.

Furthermore, house prices saw a decrease. Indeed, the median sales price was $430,300 in August compared to $436,700 in July. Interestingly, though, the average sales price was $514,000, higher than the $513,000 average seen in the prior month.

Last updated: 9:30AM EST

Stocks opened lower on Tuesday morning, with the Nasdaq 100 (NDX), S&P 500 (SPX), and the Dow Jones Industrial Average (DJIA) down by 0.69%, 0.65%, and 0.58%, respectively, at 9:30 a.m. EST, September 26.

Meanwhile, the July S&P CoreLogic Case-Shiller Home Price Index (HPI) indicated that the demand for homes continued to rise. The HPI Composite Index for 20 cities went up by 0.9% month-over-month in July on a seasonally adjusted basis, exceeding economists’ forecast of a 0.7% increase, and the rise was the same as in June.

On a year-over-year basis, the unadjusted composite index for 20 cities went up by 0.1% in July as compared to an expected decline of 0.3%.

Craig J. Lazzara, managing director of S&P DJI, commented, “We have previously noted that home prices peaked in June 2022 and fell through January of 2023, declining by 5.0% in those seven months. The increase in prices that began in January has now erased the earlier decline so that July represents a new all-time high for the National Composite.”

Interestingly, JPMorgan Chase (NYSE:JPM) CEO Jamie Dimon stated in an interview with the newspaper Times of India that in the event of interest rates going up to 7%, it may be painful for the global economy. Dimon commented, “The worst case is 7% with stagflation. If they are going to have lower volumes and higher rates, there will be stress in the system.”

He called for clients to be prepared for that kind of stress and stated, “Warren Buffet says you find out who is swimming naked when the tide goes out. That will be the tide going out. These 200 basis points (from 5% to 7%) will be more painful than (going from) 3% to 5%.”

First published: 4:24AM EST

U.S. Futures are trending in the red on Tuesday morning. At the same time, WTI crude oil futures are trending down today, near $88.59 as of the last check. Also, the U.S. 10-year treasury yields are hovering at around 4.54%. Futures on the Nasdaq 100 (NDX), S&P 500 (SPX), and the Dow Jones Industrial Average (DJIA) are down by 0.58%, 0.54%, and 0.43%, respectively, at 4:15 a.m. EST, September 26.

The three major averages ended Monday on marginally positive gains, snapping their four-day losing streaks. The Fed’s hawkish stance last week has put traders into a renewed perspective of a higher-for-longer interest rate scenario. Plus, markets now expect fewer interest cuts next year. Meanwhile, several Federal Reserve officials are slated to speak this week, and traders will watch carefully for any better clarity on the future.

On the economic front, September’s Consumer Confidence Report is due today, as are the final reading on August’s Building Permits and New Home Sales data. Turning towards earnings, membership-only retailer Costco Wholesale (COST) is scheduled to release its Q4FY23 results today.

In corporate news, Citigroup (NYSE:C) CEO Jane Fraser cautioned employees to adapt to the company’s changing organizational structure and streamlining efforts. The CEO has not yet revealed the exact number of layoffs or a cost reduction target, resulting in frustration among employees. Further, American carmaker Ford Motor Company (NYSE:F) is smacked with yet another challenge amid the ongoing strike with the United Auto Workers (UAW) union. This time, Ford has halted construction at its EV battery manufacturing plant in Michigan owing to political concerns.

In addition, Blue Origin is hiring a new CEO, Dave Limp, an ex-Amazon executive. Under his leadership, the Jeff Bezos-founded company hopes to take its rockets into the Earth’s orbit soon.

Elsewhere, European indices opened in the red on Tuesday as traders grapple with the thought of a persistently high interest rate environment. Also, Germany’s 10-year treasury yield hit a record high yesterday. Markets are also preparing for the euro zone’s inflation report, expected this week.

Asia-Pacific Markets End Lower on Tuesday

Asia-Pacific indices finished in the red zone today.

Hong Kong’s Hang Seng index and China’s Shanghai Composite and Shenzhen Component indices ended down by 1.48%, 0.43%, and 0.60%, respectively.

Similarly, Japan’s Nikkei and Topix indices finished lower by 1.11% and 0.57%, respectively.

Interested in more economic insights? Tune in to our LIVE webinar.