Rigetti Computing (RGTI), the quantum computing company, received renewed support from Needham analyst Quinn Bolton, who reiterated a Buy rating and a Street-high price target of $51, implying about 15% upside from current levels. The rating followed the company’s Q3 2025 results, which Bolton said showed steady progress and strengthened his confidence in Rigetti’s long-term plan and execution.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Bolton is a five-star analyst on TipRanks, ranking #45 out of 10,109 analysts tracked. He has a 59% success rate and an impressive average return per rating of 37%.

Q3 Results Slightly Beat Expectations

Rigetti reported Q3 revenue of $1.9 million, just above Needham’s estimate of $1.8 million but slightly below Wall Street’s forecast. The company posted a loss of $0.03 per share, narrower than both Needham’s and consensus expectations.

Bolton said the smaller loss reflected improved cost control, even though profit margins were weaker due to contract mix.

Analyst Highlights Clear Roadmap Through 2027

Bolton said Rigetti’s updated technology roadmap lays out a clear path for growth. The company targets a 150-plus qubit system with 99.7% gate fidelity by 2026, and a 1,000-plus qubit system with 99.8% fidelity by 2027.

The analyst called this a realistic timeline that supports the company’s long-term scaling plan.

Government Contracts Add Visibility

Bolton also pointed to strong progress on government partnerships. He expects Rigetti to move into Stage B of DARPA’s Quantum Benchmarking Initiative by the first quarter of 2026, calling it “a reasonable goal.” The company’s new $85.8 million contract with the U.S. Air Force Research Lab (AFRL) also adds multi-year revenue visibility.

Bolton said recent U.S. Department of Energy funding for national quantum research centers is another positive sign for the industry and should help Rigetti as it strengthens its government ties.

He added that at current levels, Rigetti continues to draw investor interest as markets look for early leaders in the emerging quantum computing space.

Is RGTI Stock a Buy?

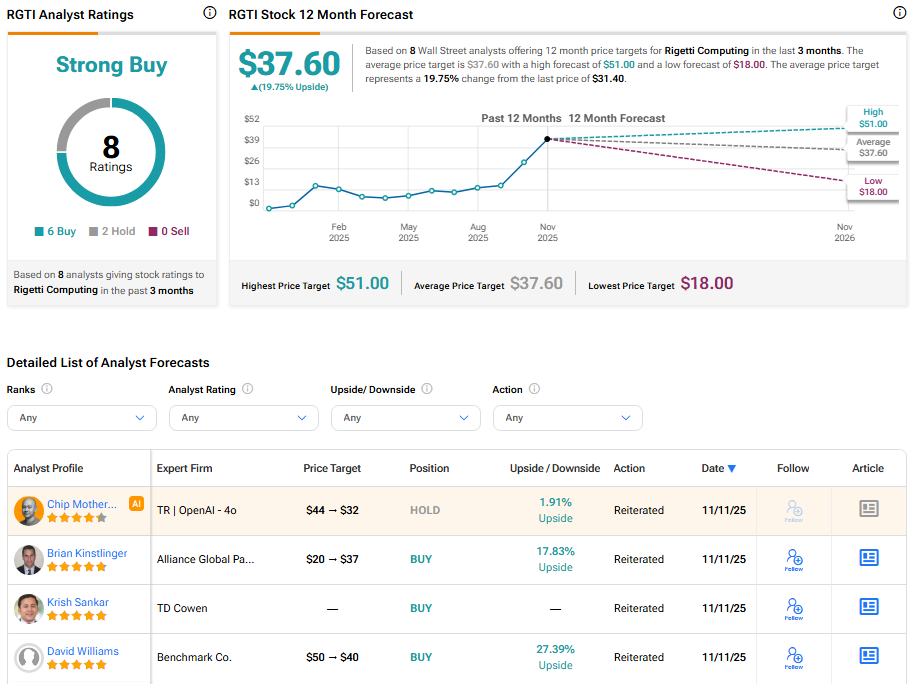

The stock of Rigetti Computing has a consensus Strong Buy rating among eight Wall Street analysts. That rating is based on six Buy and two Hold recommendations issued in the last three months. The average RGTI price target of $37.60 implies 19.75% upside from current levels.