Fast food joints and restaurant chains feature among the most impacted victims of the pandemic and have seen thousands of job losses. The National Restaurant Association estimates that the restaurant and foodservice industry lost about $120 billion in sales during the first three months of the pandemic.

Even as the economies are reopening across the world, dining is still restricted and the demand for home delivery and drive-thru pick-up has increased. Several eateries have now cut their menus to ensure faster delivery.

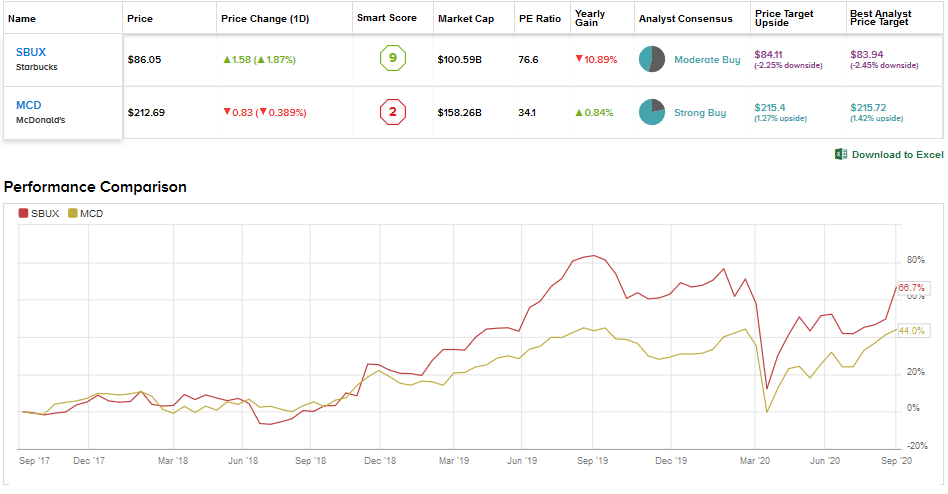

Using the TipRanks’ Stock Comparison tool, we will place Starbucks and McDonald’s alongside each other to see which stock offers a more compelling investment opportunity.

Starbucks (SBUX)

Coffee giant Starbucks expects business to improve with its stores reopening in the US and elsewhere. As of the end of July, about 97% of company-operated stores and 87% of licensed stores reopened. The company’s fiscal third-quarter (ended June 28) loss was the steepest in over a decade, reflecting the enormous impact of the pandemic.

Meanwhile, Starbucks continued to expand even in a highly uncertain environment. It opened 130 net new stores in the fiscal third quarter, ending the period with 32,180 stores, of which 51% were company-operated and the rest were licensed.

The fiscal 2020 third-quarter revenue fell 38.1% Y/Y to $4.22 billion. Global comparable sales fell 40% with Americas comps down 41% and international comps down 37%. The company slipped to an adjusted loss per share of $0.46 from an adjusted EPS of $0.78 in fiscal 2019’s third quarter as expenses deleveraged on weak sales.

For the fourth quarter, Starbucks expects adjusted EPS in the range of $0.18 to $0.33 compared to the prior guidance of $0.15 to $0.40. Global comps are predicted to decline in the range of 12% to 17% with Americas comps predicted to fall 12% to 17% and International comps anticipated to plunge 10% to 15%.

Looking ahead, the company intends to open 300 net new stores in America and at least 500 net new stores in China (Starbucks’ second-largest market) in fiscal 2020. It sees huge prospects for its Starbucks Pickup stores and intends to open over 50 of these over the next one to one and a half years in the domestic market.

Meanwhile, options like mobile order & pay, drive-thru, curbside and entryway pick-up are helping in driving improved sales. Almost 90% of third-quarter sales volumes were via drive-thru and mobile order-and-pay.

To cater to evolving consumer choices, Starbucks is also adding plant-based choices to its menu through partnerships with Beyond Meat, Impossible and Oatly.

On August 25, Stifel analyst Christopher O’Cull upgraded Starbucks to Buy from Hold and increased the price target to $90 from $78. The analyst is bullish about comps in the near-term despite headwinds like travel and breakfast declines and is upbeat about initiatives like curbside pickup and new store formats.

The analyst stated, “Our upgrade reflects our view the company is taking quick, aggressive steps to navigate these headwinds,” and believes that the initiatives will lead to steady sales recovery in the US and China. (See SBUX stock analysis on TipRanks)

A Moderate Buy consensus for Starbucks is based on 10 Buys and 12 Holds. The stock has declined 2.1% so far in 2020 and the 12-month average analyst price target of $84.11 reflects a further downside of 2.3%.

McDonald’s (MCD)

McDonald’s saw its business recover to some extent in the US in the second quarter but international sales were hurt by continued restrictions or lockdowns in several key markets. The leading foodservice retailer operates over 39,000 locations in 119 countries.

By the end of the second quarter, almost all of McDonald US restaurants were operating with drive-thru, delivery, and/or take-away options with a limited menu and limited hours. Also, about 2,000 dining rooms reopened with reduced seating capacity by June end. However, rising COVID cases impacted further reopening in June.

McDonald’s feels that the second-quarter performance was a trough and the company is adjusting its operations to the new normal. The second-quarter revenue plummeted 30% Y/Y to $3.76 billion. Same-store sales were down 23.9%, including an 8.7% decline in US comparable sales and a 41.4% decline in International Operated Markets. Adjusted EPS fell 68% to $0.66.

However, monthly same-store sales indicated improvement as June comparable sales fell 12.3% compared to a 20.9% decline in May and 39% in April. Breakfast sales continue to be hurt due to disruptions to commuting.

Looking ahead, McDonald’s plans to open 400 restaurants this year in China, including 150 added through June. Overall, the company plans to open about 950 gross (350 net new restaurants) this year. It is accelerating store closures in the US, with the plan to shut down 200 locations, half of which are low volume restaurants in Walmart stores.

Meanwhile, McDonald’s intends to invest an incremental $200 million in marketing across its domestic and International Operated Markets in the second half of 2020 to accelerate recovery. It will continue to focus on what it calls 3Ds – drive-thru, delivery and digital. The company has observed that markets with a higher percentage of drive-thrus are showing quicker recovery. Drive-thrus are present in 95% of McDonald’s locations and accounted for about 90% of the second-quarter sales. (See MCD stock analysis on TipRanks)

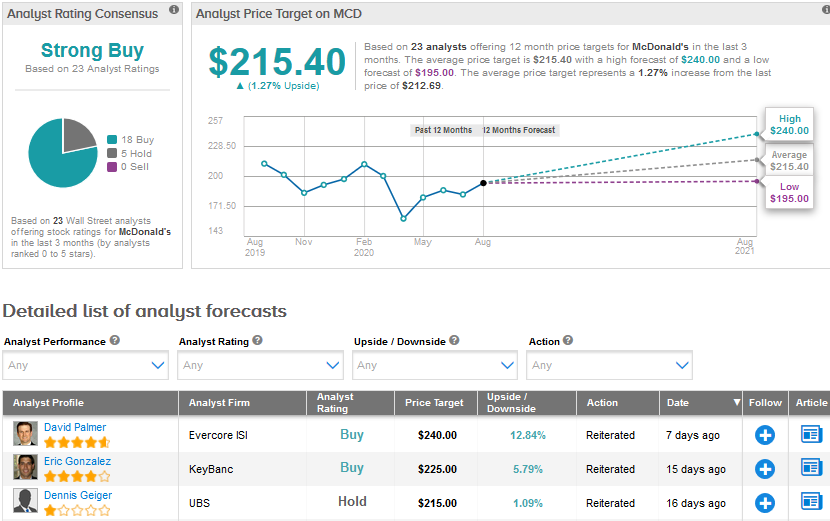

On August 18, KeyBanc analyst Eric Gonzalez increased the price target for McDonald’s stock to $225 from $215 and maintained a Buy rating. The analyst’s Key First Look Data supports accelerating sales trends in the US in recent weeks and he is bullish about McDonald’s innovation pipeline and advertising “war chest.”

The Street’s Strong Buy consensus breaks down into 18 Buys and 5 Holds. McDonald’s stock has risen over 7% year-to-date, though an average analyst price target of $215.40 indicates only a modest upside of 1.3% over the next 12 months.

Bottom line

As economies around the world reopen, both McDonald’s and Starbucks are likely to deliver improved numbers. Currently, McDonald’s looks more poised to recover faster. It experienced slightly positive US comparable sales in July. Moreover, McDonald’s is a dividend aristocrat with a dividend yield of 2.3%, which is higher than Starbucks’ yield of 1.9%.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment