Starbucks Corp. (SBUX) shares are up about 6% during pre-market trading after the company reported record sales for the second quarter yesterday.

Revenue rose 14.5% year-over-year to $7.64 billion, beating estimates by $33.5 million. Earnings per share at $0.59, on the other hand, lagged consensus by $0.01.

Q2 Performance

Globally, comparable-store sales rose 7%, and in the U.S., by 12%. Notably, this outperformance came despite inflationary challenges and COVID-19-induced lockdowns in China.

During the quarter, Starbucks opened 313 net new stores, taking the total global store count to 34,630.

Management Weighs In

Starbucks’ Interim Chief Executive Officer, Howard Schultz, said, “We are single-mindedly focused on enhancing our core U.S. business through our partner, customer, and store experiences. Given record demand and changes in customer behavior we are accelerating our store growth plans, primarily adding high-returning drive-thrus, and accelerating renovation programs so we can better meet demand and serve our customers where they are.”

Commits $1 Billion to Uplift Starbucks Partners

Additionally, Schultz also announced that Starbucks will invest about $1 billion in 2022 in partners and stores, focusing on areas including higher pay, improved training and collaboration, and store innovation.

The move is expected to help the company meet customer demand and the needs of its partners in the present COVID-19 environment.

Analyst Take

Yesterday, Stifel Nicolaus analyst Chris O’Cull reiterated a Hold rating on the stock alongside a price target of $84.

Overall, the Street has a Moderate Buy consensus rating on Starbucks based on 10 Buys and nine Holds. At the time of writing, the average Starbucks price target was $103.37, which implies a potential upside of 39.1%. That’s after a nearly 36.3% slide in the stock so far this year.

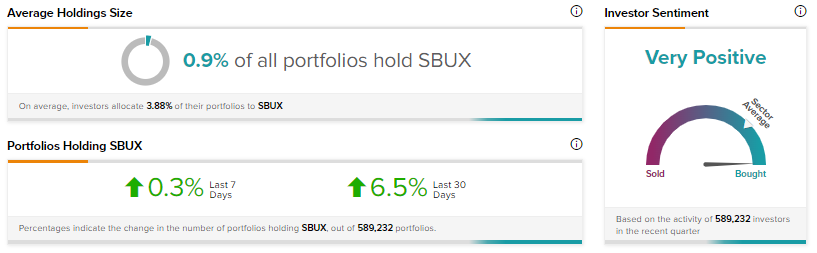

Retail Investors Remain Positive

TipRanks data indicates investor sentiment remains Very Positive about Starbucks. The number of portfolios holding Starbucks has increased by 6.5% in the last 30 days alone.

Closing Note

Amid inflationary challenges, rising wage pressures, and unionization headwinds, Starbucks has delivered record quarterly sales. Moreover, Howard Schultz’s return can be a boost to both investor confidence as well as Starbucks’ workforce.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

What Pulled Chegg Stock Down 32% on Monday?

Onsemi Stock Rallies on Upbeat Q1 Results

Avis Budget Drives to Strong Q1 Results