Starbucks (NASDAQ:SBUX) shares advanced in Tuesday’s extended trading session as the leading coffee chain announced an upgraded revenue and profit outlook for the next three fiscal years. The improved guidance reflects the impact of initiatives being taken under Starbucks’ Reinvention plan. The company also announced an incremental investment of $450 million in its existing U.S. store network in Fiscal 2023 to enhance its operations.

Starbucks shares rose 2.5% in Tuesday’s extended trading session in reaction to the updates provided at the company’s Investor Day event. However, SBUX shares are down nearly 24% year-to-date amid macro woes and unionization efforts by baristas at multiple locations. The company recently announced the appointment of Laxman Narasimhan as its new CEO, who will succeed interim CEO Howard Schultz in April 2023.

Starbucks’ Improved Financial Outlook

Starbucks now expects adjusted EPS growth in the range of 15% to 20% per year in Fiscal 2023-2025, compared to the previous growth expectation of 10% to 12%. The improved outlook is supported by Starbucks’ Reinvention plan which includes continued expansion of its store footprint, efforts to enhance store efficiency and margins, and a focus on innovation.

Meanwhile, annual revenue growth is expected to be in the range of 10% to 12% from Fiscal 2023-2025, up from the prior growth outlook of 8% to 10%. Starbucks now anticipates comparable sales growth of 7% to 9%. The improved guidance also reflects the expected recovery in the company’s operations in China following COVID-led lockdowns.

Starbucks expects its global store network to grow (on a net basis) by nearly 7% annually in Fiscal 2023-2025, up from the prior target of 6%. The company aims to operate nearly 45,000 stores by the end of 2025 and about 55,000 stores by 2030, with a focus on rapid expansion in China.

Investments to Revamp Stores

Starbucks will invest an additional $450 million in its existing U.S. store base in Fiscal 2023, with continued investments planned over the next two fiscal years. The company intends to expand the presence of formats like pick-up, delivery-only, drive-thru-only locations, and mobile ordering.

The company will roll out new equipment and technology that will save time and effort. These initiatives are expected to reduce the burden on baristas, who have been unionizing across the country to express their anger over wages and work pressure. Last month, Starbucks announced market-beating results for Q3 FY22 but highlighted that its margins were under pressure due to inflation and higher wages.

What Is the Target Price for SBUX Stock?

UBS analyst Dennis Geiger opines that while growth investments are necessary, they might limit the Fiscal 2023 operating margin. However, Geiger expects the company’s ongoing efforts to drive margin expansion in future years. Geiger reiterated a Hold rating on SBUX stock.

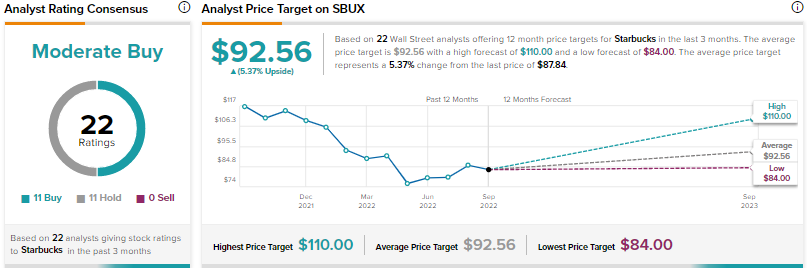

The Street is divided on Starbucks, with a Moderate Buy consensus rating based on 11 Buys and 11 Holds. The average SBUX price target of $92.56 implies 5.4% upside potential.

Conclusion

While Starbucks continues to face near-term pressure, it is optimistic about its long-term potential, supported by its Reinvention plan. However, Wall Street is treading cautiously as high inflation and union issues continue to be a drag.