On the surface, the downgrade that coffee giant Starbucks (NASDAQ:SBUX) took at Jefferies makes some sense. With a souring economy and rampant inflation, it’s understandable that fewer people would buy fancy coffee. Despite this, however, Starbucks shares are actually up slightly in Wednesday afternoon trading.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Jefferies, via analyst Andy Barish, cut Starbucks’ rating from Buy to Hold. However, Jefferies kept the current share price target of $100. Barish noted that, if the economy should further slide over the next year or so, the move away from expensive beverages will likely only continue and hit the company hard. Nonetheless, reports that suggest China may be abandoning the Zero Covid policies that kept much of the country locked down may help offset the negative impact.

Starbucks shares are already down 4.1% this month. Further, some are convinced that the U.S economy is already in a recession. That may make Jefferies’ downer forecast a bit more likely to happen than expected. New developments haven’t helped matters much, either. With a new digital tipping plan irking customers and unionization picking up steam, Starbucks’ near-term future is under some stress.

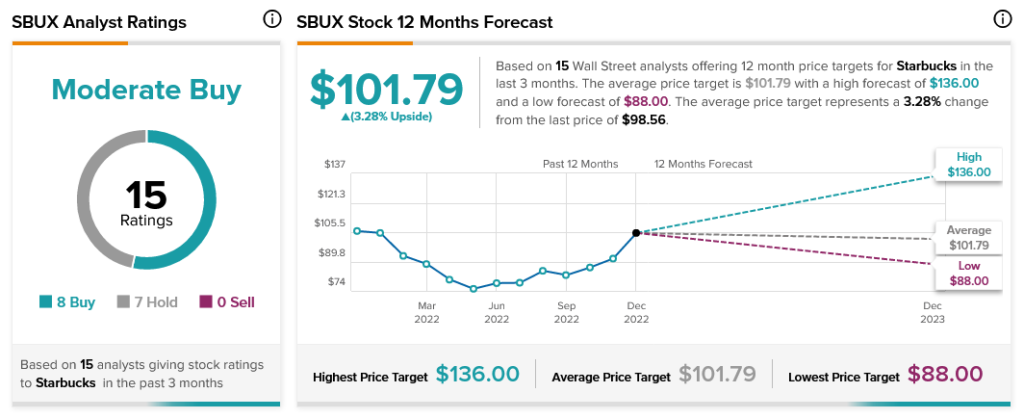

Despite this, analysts believe there’s life left in Starbucks. Analyst consensus calls Starbucks a Moderate Buy, with one more Buy than Hold recommendation. The stock also has 3.28% upside potential thanks to its average price target of $101.79.