Stanley Black & Decker (SWK) inked a deal to snap up Excel Industries in an all-cash transaction worth $375 million.

Excel designs and manufactures premium commercial and residential turf-care equipment serving around 1,400 active independent equipment dealer outlets in the United States and Canada under the brands Hustler Turf Equipment (Hustler) and BigDog Mower Co. (BigDog). Excel is forecast to generate revenues of around $375 million in FY2021.

The addition of Excel will expand SWK’s range of commercial outdoor equipment product offerings and bring in an extensive dealer network.

The deal is expected to be modestly accretive to earnings in the first year. From the third year onwards, the accretion to EPS is expected to be $0.15 – $0.20, excluding charges. (See Stanley Black & Decker stock charts on TipRanks)

SWK’s CEO, James M. Loree, said, “This is a strategically important bolt-on acquisition as we build an outdoor products leader. Excel brings a range of premier, commercial grade and prosumer turf-care equipment, an extensive dealer network, a talented team and a loyal customer base.”

The acquisition, subject to certain regulatory approvals, will be financed with available cash and borrowings.

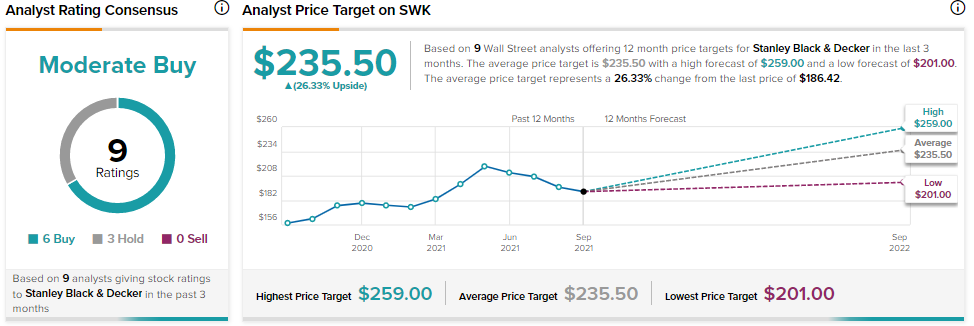

Goldman Sachs analyst Joe Ritchie recently lowered the price target from $228 to $221(7.8% upside potential) while reiterating a Hold rating on the stock.

Overall, the stock has a Moderate Buy consensus rating based on 6 Buys and 3 Holds. The average Stanley Black & Decker price target of $235.50 implies 26.3% upside potential from current levels.

Related News:

Genius Sports Beats Q2 Revenue Expectations; Shares Leap

LyondellBasell Weighs Strategic Options for Refining Business; Shares Drop 2.3%

Concrete Pumping Holdings Delivers Mixed Q3 Results, Shares Drop 2.8%