SS&C Technologies (SSNC) has signed another customer for its Eze solution. Hong Kong-based CSOP Asset Management will use Eze Investment Suite for trading and portfolio management workflows.

SS&C describes Eze Investment Suite as a one-stop-shop solution for running investment operations in a streamlined manner. The solution is cloud-based and can be accessed through both public and private clouds. Moreover, Eze Investment Suite can be used alone or paired with third-party systems.

CSOP is China’s first offshore asset manager. It will use Eze Investment Suite to run its daily trading activity across diverse asset classes. In addition to trading, the solution will help the fund manager with modeling, reporting, and settlement operations.

CSOP facilitates foreign investment in China. Therefore, it counts on Eze Investment Suite to enable it to offer international investors better exposure to China’s capital markets.

“We are pleased to support CSOP’s foreign investment in China and the ETF space,” commented Michael Hutner, SS&C Eze general manager.

SS&C Technologies sells software and services targeting financial services and healthcare industries. It serves some 18,000 enterprises. Signing CSOP as customer for Eze advances SS&C’s efforts to support product innovation among Asian asset managers with robust systems. (See SS&C Technologies stock analysis on TipRanks)

Needham analyst Mayank Tandon reiterated a Buy rating on SSNC stock and raised the price target to $90.00 from $80. Tandon’s new price target implies 22.90% upside potential. The analyst maintained a bullish view on the stock following strong first-quarter results and upbeat Fiscal 2021 outlook.

“SSNC raised FY21 guidance, which now calls for an improvement in customer buying activity as the year progresses, while maintaining healthy (95-96%) net revenue retention in the existing client base,” noted Tandon.

Consensus among analysts is a Strong Buy based on 7 Buys and 1 Hold. The average analyst price target of $83.29 implies 13.74% upside potential to current levels.

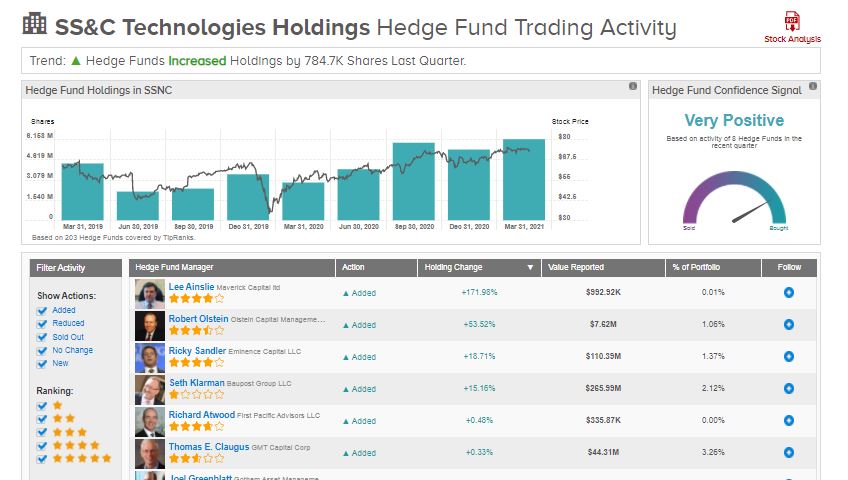

According to TipRanks’ Hedge Fund Trading Activity tool, confidence in SSNC is currently Very Positive, as the cumulative change in holding across 8 hedge funds that were active in the last quarter was an increase in 17.9 million shares.

Related News:

Cisco Taps AT&T to Help It Sell Webex to Enterprise Customers

Zumiez Posts Blowout Q1 Results; Shares Pop

Wide Street Beat for Broadcom