Shares in Square Inc. are advancing almost 9% in early trading as the payment processor posted a 64% increase in quarterly sales driven by shoppers making more online purchases using its Cash App.

The stock is currently appreciating to $149.50 in Wednesday’s pre-market trading. Revenue in the second quarter leaped 64% to $1.9 billion, beating analysts’ estimates of $1.1 billion. In the three months ended June 30, Square’s (SQ) Cash App gross profit jumped 167% year-on-year as customers increasingly used the app as a way to send and spend money. Moreover, the Cash App generated $875 million of bitcoin revenue during the second quarter, up 600% year-on-year. In June, the Cash App had more than 30 million monthly transacting active customers.

During the reported period, the company posted a loss of $11.5 million, or 3 cents per share, compared with a loss of $6.7 million, or 2 cents per share last year. The 2Q EPS figure exceeded analyst consensus by $0.21.

Looking beyond the reported quarter, Square said that in July, the Cash App generated strong revenue and gross profit growth year over year.

“Compared to June, we saw month-over-month increases in volume per transacting active Cash App customer across peer-to-peer payments, Cash Card, and bitcoin investing,” the company said in a letter to shareholders. “We recognize this increase may be partially driven by government stimulus and unemployment benefits, which may not sustain at the same levels during the remainder of the third quarter.”

With SQ shares up 119% year-to-date, Rosenblatt Securities analyst Kenneth Hill says that he views the strong second-quarter results as supportive of that performance.

“Overall, our price target and estimates are under review, but we remain buyers,” Hill wrote in a note to investors. “Our one-year price target is $136, applying our sum-of-the-parts framework for SQ’s Cash App and Seller ecosystems.”

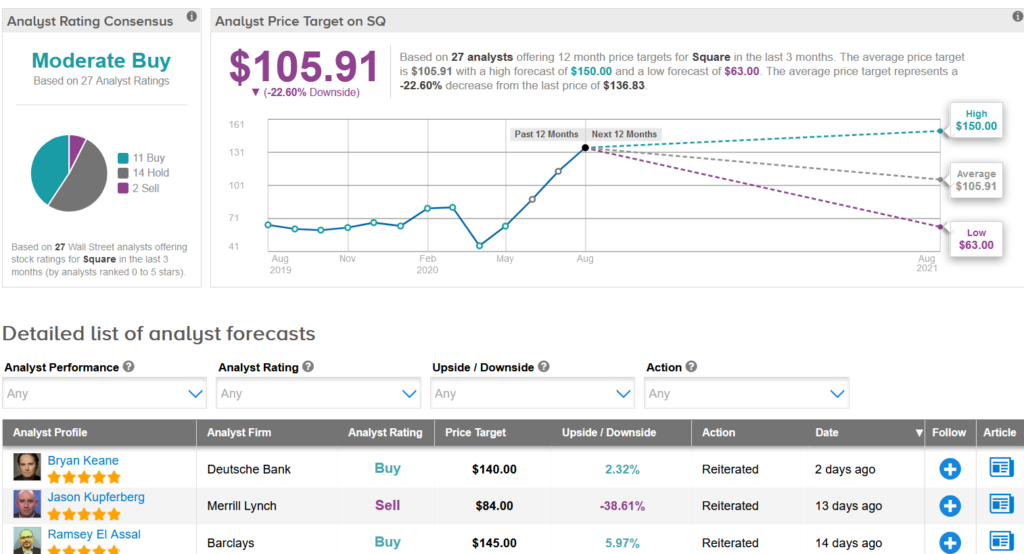

Wall Street analysts have a Moderate Buy analyst consensus on the stock which breaks down into 11 Buys, 14 Holds and 2 Sells. The $105.91 average price target indicates 23% downside potential in the shares in the coming 12 months. (See Square stock analysis on TipRanks).

Related News:

Beyond Meat Dips 9% As Covid-19 Costs Widen 2Q Loss; Analyst Says Hold

Disney Soars 4% After-Hours On Strong Subscriber Growth

Amazon Rises 5% As ‘King Of E-Commerce Shines Amidst The Pandemic’