Financial services and digital payments company Square, Inc. (SQ) announced that it has entered into a Scheme Implementation Deed to acquire financial technology company Afterpay Limited for $29 billion. The deal is likely to close in the first quarter of Calendar Year 2022.

As per the terms of the deal, Afterpay shareholders will receive a fixed exchange ratio of 0.375 shares of Square Class A common stock for each Afterpay ordinary share they hold on the record date. Also, Square may opt to pay 1% of the total consideration in cash.

With this buyout, Square will have access to Afterpay’s global ‘buy now, pay later’ (BNPL) platform. In fact, Square is looking to incorporate the BNPL platform into its Seller and Cash App to offer its customers a more efficient payment solution mechanism.

Although, Square expects a slight fall in its adjusted EBITDA margins in the first year, after completion of the deal, the company believes it to be accretive to its gross profit growth.

The CEO of Square, Jack Dorsey, said, “Square and Afterpay have a shared purpose. We built our business to make the financial system more fair, accessible, and inclusive, and Afterpay has built a trusted brand aligned with those principles. Together, we can better connect our Cash App and Seller ecosystems to deliver even more compelling products and services for merchants and consumers, putting the power back in their hands.” (See Square stock chart on TipRanks)

On August 1, Mizuho Securities analyst Dan Dolev reiterated a Buy rating on the stock. The analyst’ price target of $380 implies upside potential of 53.7% from current levels.

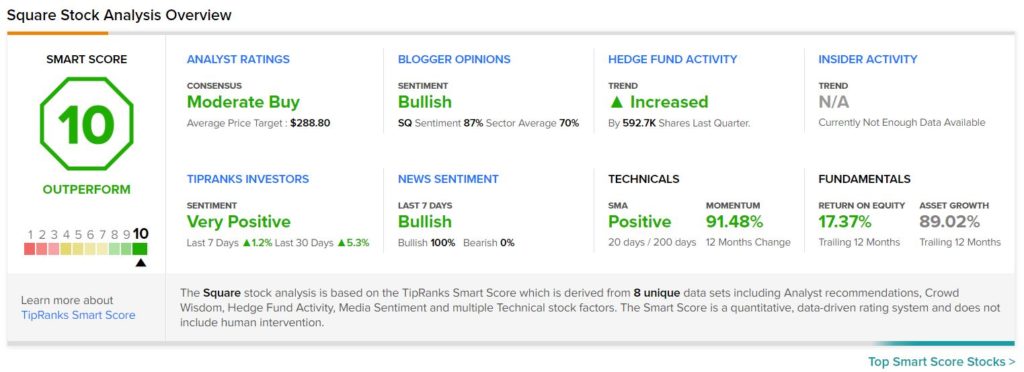

The stock has a Moderate Buy consensus based on 16 Buys, 4 Holds and 1 Sell. The average Square price target of $288.80 implies 16.8% upside potential from current levels.

Square scores a “Perfect 10” on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations. Shares have gained 83.4% over the past year.

Related News:

Merck Q2 Earnings and Revenue Miss Estimates

T-Mobile Q2 Results Top Estimates; Street Says Buy

Upwork Q2 Results Beat Estimates; Shares Fall 4.4%