Process solutions provider SPX Flow, Inc. (FLOW) confirmed yesterday that it had rejected Ingersoll Rand, Inc.’s (IR) all-cash buyout bid of $85 per share. Shares of FLOW soared 22.3% to close at a new all-time high of $75.93 on July 19, while IR fell 4% to close at $46.25.

Ingersoll Rand, a global provider of mission-critical flow creation and industrial solutions, approached the Board of SPX Flow on June 10 with an unsolicited, conditional, and non-binding proposal to acquire all of its outstanding shares for $85 per share in cash. The bid represented a 20% premium over FLOW’s all-time high closing price.

However, FLOW’s Board rejected the offer on June 21, claiming that it was not in the best interest of its shareholders and did not project the full value of its business and potential growth prospects. (See SPX Flow stock charts on TipRanks)

Vicente Reynal, Ingersoll Rand President and CEO, said, “We believe that SPX Flow has a strong strategic fit with Ingersoll Rand…while we had hoped to complete a transaction privately, we remain committed to engaging with SPX Flow on a friendly basis and in a constructive and collaborative manner.”

The SPX Board remains confident that it will deliver greater value to its shareholders through its strategic growth plan, the progress of which will be discussed with the second quarter results scheduled for August 4.

As per the Earnings Whisper numbers, FLOW is expected to report earnings of $0.59 per share on revenue of $366.45 million in the second quarter.

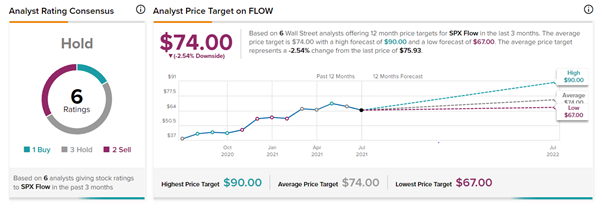

Following the news, Stifel Nicolaus analyst Nathan Jones reiterated a Hold rating on the stock while lifting the price target to $90 (18.5% upside potential) from $83.

Jones believes Ingersoll’s bid of $85 per share represents a compelling starting price for negotiations and could result in a higher price for FLOW. He also urges FLOW’s Board to explore all options to maximize shareholder value.

The stock has an overall Hold consensus rating based on 1 Buy, 3 Holds, and 2 Sells. The average SPX Flow price target of $74 implies 2.5% downside potential to current levels. Shares have gained 103% over the past year.

Related News:

Pershing Square Tontine Withdraws from Universal Music Investment

Ford Recalls Vehicles; Shares Sink 2.9%

Why MoneyGram Stock Spiked on Friday?