Audio streaming giant Spotify (NYSE: SPOT) recently held its first investor day since going public in 2018. At the investors’ meet, CEO Daniel Ek announced some ambitious targets, which are to be achieved over the next decade.

Shares of Spotify rose more than 6.3% to close at $116.39 in Wednesday’s extended trading session.

Company’s Goals

Since its listing, SPOT stock has not been much of a wealth creator. Unfortunately, it has declined 21.6% in the last four years. Further, the stock has tanked 55% so far this year.

Amid its profitability concerns, the CEO announced that the audio streaming platform was aiming to reach one billion listeners by 2030 and generate revenues and gross margin of $100 billion and 40%, respectively.

Presently, the company’s gross margin in its core music streaming business is about 28.5%. The company has a long term aim of boosting this to 30-35%.

Podcasts & Audiobooks

One of the main revenue drivers for Spotify has been podcasts. To that end, the company, in the last three years, has forked out about $1 billion on podcast deals, with top names like Joe Rogan and Kim Kardashian West on its ranks. Despite this, the company’s podcasts category accounts for just 7% of the listening time on the platform and is yet to be profitable. The company expects this category to be profitable in the next couple of years and generate a potential gross margin of 40-50%.

Meanwhile, when it comes to audiobooks, Spotify’s Head of Audiobooks, Nir Zicherman, said that the category has been witnessing a growth of 20% every year. Further, the CEO expects that the company can derive about $70 billion in annual revenue and gross margins of over 40% from the segment.

Notably, to strengthen its audiobook segment, Spotify has announced the acquisition of Findaway, an Ohio-based global digital audiobook distributor, for about $125 million.

Stock Rating

Recently, Raymond James analyst Andrew Marok upgraded the stock to Buy from Hold with a price target of $150, which implies upside potential of 29.3% from current levels.

Overall, the Street is cautiously optimistic about the stock and has a Moderate Buy consensus rating based on 13 Buys, nine Holds and one Sell. SPOT’s average price target of $150.59 implies that the stock has upside potential of 29.8% from current levels. Shares have declined 51.2% over the past year.

Website Traffic

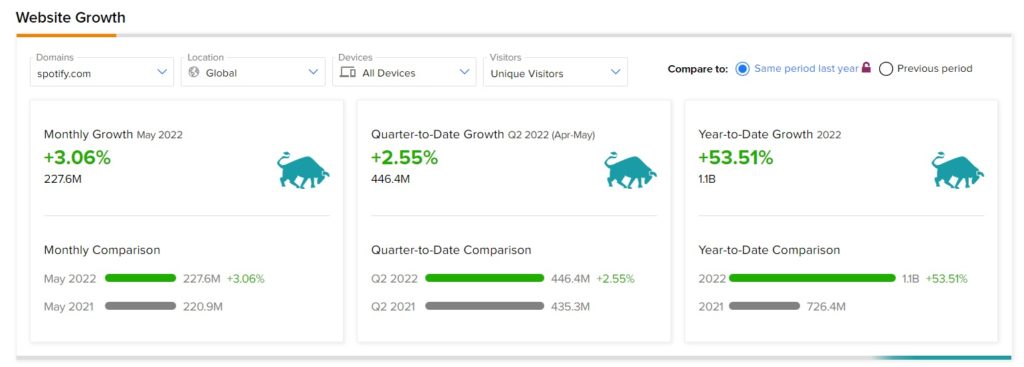

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into Spotify’s performance this quarter.

According to the tool, the Spotify website recorded a 3.06% monthly rise in global visits in May, compared to the same period last year. Further, the footfall on the company’s website has grown 53.51% year-to-date, compared to the previous year.

The increased number of visits to the company’s website hints at its strong growth prospects and performance in the quarters ahead.

Conclusion

The top management of Spotify has laid down some ambitious targets for its future growth. However, the company has not disclosed how it plans to achieve the same.

Read full Disclosure