Audio streaming platform Spotify Technology SA (NYSE: SPOT) has reported mixed results for the first quarter of 2022. Earnings stood at €0.21 per share, compared with the year-ago loss and the Street’s loss estimate of €0.25 per share.

Revenues grew 24% year-over-year to €2.66 billion but fell short of analysts’ expectations of €2.83 billion. Premium revenue increased 23% to €2.4 billion and Ad-Supported revenue rose 31% to €282 million.

The number of premium subscribers jumped 15% year-over-year to 182 million, which was marginally below the company’s guidance due to the loss of around 1.5 million subscribers as a result of Spotify’s exit from Russia.

Total monthly active users (MAUs) grew 19% to 422 million and gross margin decreased 29 basis points to 25.2%.

“Nearly all of our key metrics surpassed guidance, led by MAU outperformance, healthy revenue growth, and better gross margin. Excluding the impact of our exit from Russia, subscriber growth exceeded expectations as well,” Spotify said in a release.

Q2 Guidance

For the second quarter, the company expects total MAUs to stand at 428 million and premium subscribers to total 187 million.

Further, Spotify anticipates revenues to amount to €2.80 billion, gross margin to come in at 25.2% and an operating loss of $197 million.

The Luxembourg-based company said, “These expectations reflect the full closure of Spotify’s services in Russia, which was completed on April 11, 2022.”

Wall Street’s Take

After the first-quarter results were announced, Goldman Sachs (NYSE: GS) analyst Eric Sheridan maintained a Hold rating on the stock and lowered the price target to $150 from $181 (55.2% upside potential).

In a research note to investors, the analyst said, “The company’s Q1 results were generally in line, but unfortunately, the current market environment seems unforgiving for long-tailed profit narratives.”

Overall, the stock has a Moderate Buy consensus rating based on 13 Buys, 11 Holds and one Sell. Spotify’s average price target of $208.17 implies 115.3% upside potential.

Website Traffic

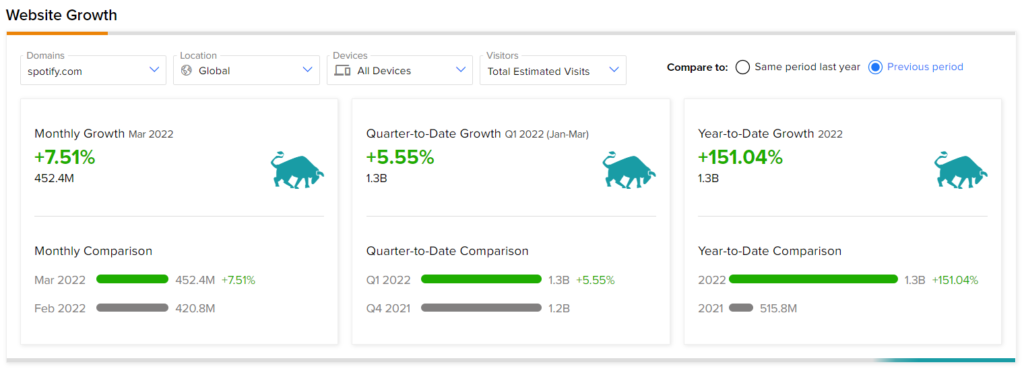

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (NYSE: SEMR), the world’s biggest website usage monitoring service, offers insight into Spotify’s first-quarter performance.

According to the tool, Spotify’s website traffic registered a 7.5% rise in global visits in March compared to February. The tool also showed that the website traffic increased 5.6% in the first quarter, compared to the fourth quarter of last year.

The uptrend in the company’s website visits supports the year-over-year rise in its revenues and earnings. This shows that TipRanks’ website traffic tool helps in making reliable predictions about a company’s results.

Conclusion

Following the announcement of the results on Wednesday, SPOT stock declined 12.4%. The fall was the result of the conservative guidance that the company provided for the second quarter.

Spotify can be seen as a long-term investment option as the company is focused on expanding its subscriber base, making the most of the advertising opportunity and boosting its podcasting content and engagement.

Learn more about the Website Traffic tool in this video by Youtube sensation Tom Nash.

Read full Disclaimer & Disclosure

Related News:

Mattel’s Q1 Performance Likely to Attract Better Buyout Offer

Riding on Strong Demand, Harley-Davidson Surpasses Q1 Revenue Expectations

Why Did Boeing Drop to an All-Year Low?