Technology bigwig Intel Corporation’s (NASDAQ: INTC) CEO Patrick Gelsinger has reportedly met with Korean semiconductor giant Samsung Electronics’ top brass for possible talks of collaboration, The Korea Herald stated.

Intel has been in a tough spot since last year due to the stiff competition from other chip giants, mainly Taiwan Semiconductor (TSM). INTC stock has lost nearly 15% year to date.

Chip Giants Discuss Collaboration

According to the report, Gelsinger flew to Seoul after attending the 2022 World Economic Forum in Davos, Switzerland. He met with Samsung Electronics Vice Chairman Lee Jae-yong; Co-CEO, Kyung Kye-hyun; Head of Samsung Mobile, Roh Tae-moon; and a few others from various chip-making divisions.

Although specifics of the meeting are unknown, speculation is rife about a possible collaboration between the two giants to compete effectively in the powerful and most watched next-generation chip manufacturing market. As per Samsung officials, talks might have revolved around memory chips, fabless logic chips, foundries, PCs, and mobile phones.

Should any material deal arise from the meeting, it is sure to prove highly beneficial, especially for Intel, which is trying to make its way to the top of the game. While Intel is facing difficulties in breaking through the 10-nanometer barrier, Samsung has already achieved the feat.

Intel has also had prior collaborations with both TSMC and Samsung Electronics for contract chip manufacturing. Both Intel’s processors and Samsung’s memory chip modules are used on the same motherboard.

Intel Stock Prediction

The Wall Street community has a Hold consensus rating on INTC stock based on five Buys, eight Holds, and six Sells. The average Intel price target of $50.13 implies 12.5% upside potential to current levels.

Risk Analysis

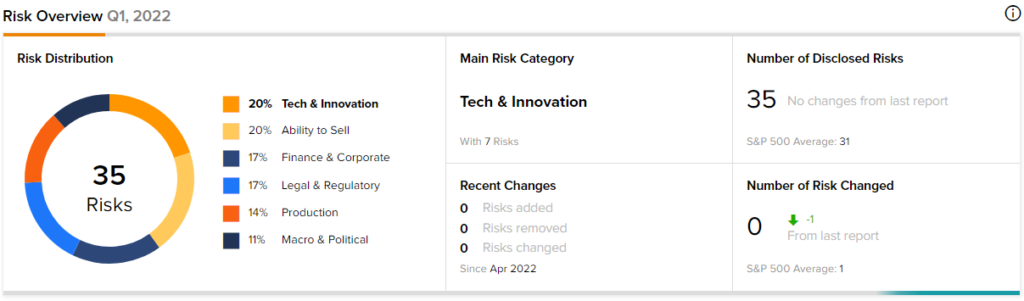

According to the new TipRanks Risk Factors tool, Intel stock is at risk mainly from two factors: Tech & Innovation and Ability to Sell, each contributing 20% to the total 35 risks identified for the stock.

Ending Thoughts

As is evident from the risk factors, Intel’s lack of innovation and selling prowess may prove to be a bottleneck for its performance. Additionally, both retail investors and hedge funds have trimmed their positions in the stock during the last quarter, indicating that investors might be wary about this stock.

Read full Disclosure.