Southwest Airlines Co. (NYSE: LUV) has delivered impressive results for the second quarter of 2022. Its earnings and sales surprise in the quarter stood at 11.1% and 0.6%, respectively.

Despite upbeat results, high costs and lackluster projections marred investors’ sentiments for the stock. Shares of this $22.6-billion passenger airline company were down 6.4% to close at $38.15 on Thursday.

Highlights of LUV’s Q2 Results

The CEO of Southwest Airlines, Bob Jordan, said that the company reported “all-time record” revenues and adjusted net income in the second quarter.

Specifically, the airline’s adjusted earnings were $1.30 per share in the second quarter, higher than the consensus estimate of $1.17 per share and the year-ago tally of ($0.35) per share.

Jordan added that the results benefited from high travel demand, which offset the impacts of “inflationary pressures and headwinds from operating at suboptimal productivity levels.”

Revenues in the quarter were $6.73 billion, up from the consensus estimate of $6.69 billion. Also, the top line grew 67.9% year-over-year, driven by an increase of 71.4% in passenger sales and a 44.5% rise in other revenues. A 6% decline in freight sales played spoilsport in the quarter.

Meanwhile, revenue passenger miles (RPM) grew 17.5% year-over-year to $32.5 billion, while available seat miles (ASM) at $37.3 billion reflected an increase of 11.7%. The load factor was up 4.2 percentage points to 87.1%. The airline’s fleet size was 730 at the end of the second quarter, down 0.8% year-over-year.

The impact of revenue growth in the quarter was partially offset by a 100% increase in fuel and oil expenses. Operating income in the quarter was $1.17 billion versus ($0.16) billion in the year-ago quarter.

The company generated a cash flow of $1.91 billion from its operating activities in the second quarter, while its cash and cash equivalents were $13.23 billion at the end of the quarter.

From its cash resources, the company used $987 million on capital expenditures, $53 million to repay long-term debts, and $178 million on convertible debts. Long-term debts were $8.88 billion at the end of the quarter.

LUV’s Projections for Q3 and 2022

For the third quarter of 2022, the company anticipates operating revenues to grow 8%-12% from the comparable quarter in 2019. ASM is forecast to be flat.

For 2022, the company expects ASM to be down 4% from the 2019-level. Economic fuel costs per gallon are forecast to be $2.95-$3.05 in the year, higher than the previous range of $2.75-$2.85. The fleet size is expected to be 765, down from 814 projected earlier, due to delays in aircraft deliveries.

Analysts Are Cautiously Optimistic about Southwest Airlines

On TipRanks, Southwest Airlines has a Moderate Buy consensus rating based on nine Buys and four Holds. LUV’s average price forecast is $53.69, mirroring upside potential of 40.73% from the current level.

Over the past year, shares of Southwest Airlines have declined 26%.

Website Traffic Reflects LUV’s Top-Line Strength

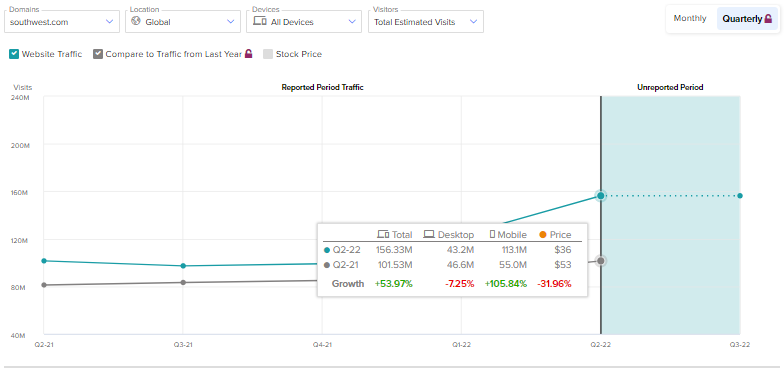

According to TipRanks, the total estimated traffic to LUV’s website increased 54% year-over-year in the second quarter of 2022. The uptick in the website traffic supports the company’s sales surprise and year-over-year growth.

Concluding Thoughts

Southwest Airlines is well-positioned to leverage high leisure demand in the industry. Its fundamentals are solid, evident from the rise in RPM and increase in passenger revenues. A 30.6% year-to-date rise in website traffic suggests solid top-line prospects for the company. However, high costs and lower fleet projections for 2022 are worrying.

Read full Disclosure