Between Sony (NYSE:SONY) and Microsoft (NASDAQ:MSFT), you’ve got a major chunk of the video gaming market right there. So when Sony’s plans are revealed after a hacker staged a cyber attack, that’s a major development. It didn’t hurt Sony especially hard, though, as Sony slipped fractionally in Tuesday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The hack managed to land much of Sony’s roadmap for the next several years, and the hackers, in turn, leaked the roadmap. The hackers made off with nearly 16 terabytes of data, which included plans for a third installment of “Spider-Man” and games built around the “X-Men” franchise and the “Venom” franchise/character. A new game featuring fan-favorite Wolverine is expected out in 2026, the plans revealed, and long-time fan-favorite series “Ratchet & Clank” will also get a new installment. However, that won’t hit until 2029. For its part, Sony kept quiet about the whole affair.

Sony Takes Microsoft Very Seriously

Anyone who follows video gaming knows that Microsoft is easily Sony’s primary competitor. Thanks to its own console plus its control of the PC market, Microsoft is a potent force in the field. Indeed, the hack revealed that Sony is quite concerned about Microsoft, especially after its move to acquire Activision Blizzard back in October. An entire section of files labeled “Industry major shifts and threats” revealed that Microsoft’s increasing push for Game Pass was also quite threatening to Sony.

Further, Sony is also planning to hike game prices before 2027 hits, going from the current $70 to between $80 and $100 per, thanks to rising production costs. That likely won’t sit well with gamers, who are just as pinched by inflation as everyone else.

Is SONY a Buy or Sell?

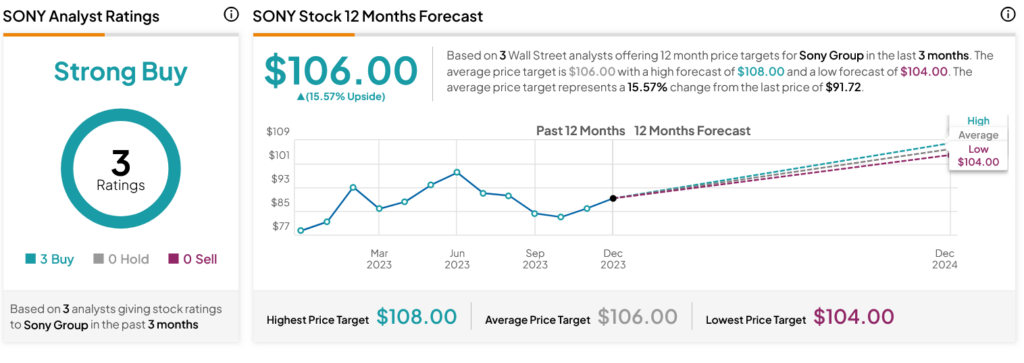

Turning to Wall Street, analysts have a Strong Buy consensus rating on SONY stock based on three Buys assigned in the past three months, as indicated by the graphic below. After an 18.37% rally in its share price over the past year, the average SONY price target of $106 per share implies 15.57% upside potential.