Sonnet BioTherapeutics, Inc. (SONN) is a biotechnology company with a focus on oncology. Its proprietary platform is targeted at biologic drugs of single or bispecific action.

SONN has completed preclinical studies of its candidates SON-1010 and SON-080. In H1 2022, SONN expects to initiate a US clinical trial for SON-1010 in patients with solid tumors.

Additionally, it has identified a new bispecific product candidate, SON-1410, with target indications for melanoma and renal cancers. Its first bispecific candidate is SON-1210 and an NHP study is expected to begin in H1 2022.

Due to an increase in the number of outstanding shares to ~24.55 million from ~9.4 million a year ago, the company’s net loss per share decreased to $1.02 from $6.96 a year ago.

With these major developments in mind, let us take a look at the changes in SONN’s key risk factors that investors should know.

Risk Factors

According to the TipRanks Risk Factors tool, Sonnet Therapeutics’ top two risk categories are Tech & Innovation and Finance & Corporate, contributing 36% and 25% to the total 64 risks identified, respectively. Compared to a sector average of 26%, SONN’s Tech & Innovation risk factor is at 36%.

In its recent annual report, the company has removed one key risk factor under the Macro & Political risk category.

The risk pertains to uncertainties stemming from currency rate gyrations. SONN had specifically highlighted that fluctuations between the Pound Sterling and the U.S. dollar may negatively affect it. While the company is based in the U.K., it sources certain services from the U.S. and the E.U. Additionally, the company does not have any exchange rate hedging arrangements.

At the end of September 2021, the company had $27.6 million in cash on hand. Furthermore, if all existing warrants for SONN get exercised, then it could receive up to $75.2 million in additional capital, which will enable the company to carry out R&D activities, a key necessity for clinical-stage biotech stocks.

Wall Street’s Take

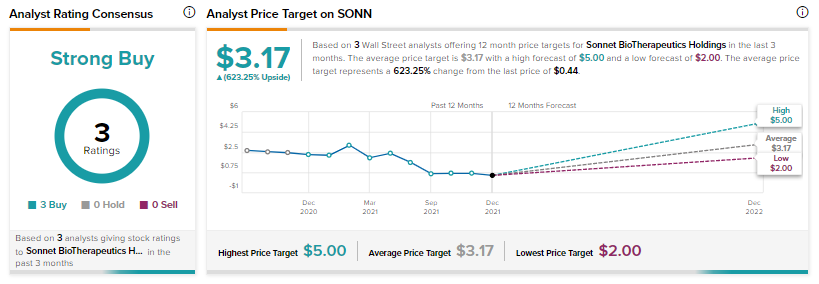

On December 20, H.C. Wainwright analyst Michael King reiterated a Buy rating on the stock alongside a price target of $2 (356.3% upside potential).

Consensus on the Street is a Strong Buy based on 3 unanimous Buys. The average Sonnet BioTherapeutics price target of $3.17 implies a potential upside of 623.2%. That’s after a 71% drop in the share prices over the last six months.

Related News:

Freshworks Reveals Settlement of Lawsuit Filed by Zoho

Merck & Ridgeback’s Molnupiravir Receives Special Emergency Approval in Japan

Cassava Introduces Clinical Website to Aid Phase 3 Simufilam Study