Smart energy technology firm SolarEdge Technologies, Inc. (NASDAQ: SEDG) has reported mixed results for the first quarter of 2022. Even though adjusted EPS jumped to $1.20 from $0.98 in the same quarter last year, it missed the Street’s estimate of $1.28.

Meanwhile, revenues surpassed analysts’ expectations of $635.47 million to reach a record $655.1 million, reflecting a year-over-year rise of 62%.

The solar segment’s revenues also grew 62% to $608 million. Further, the company shipped 2.13 Gigawatts (AC) of inverters during the quarter.

Q2 Guidance

Along with the first-quarter results, SolarEdge provided guidance for the second quarter. It expects revenues to lie in the range of $710 million to $740 million versus the consensus estimate of $687.12 million.

Revenues from the solar segment are projected to range from $660 million to $690 million.

About SolarEdge

Headquartered in Israel, SolarEdge Technologies is engaged in the operation of inverter solutions for the harvesting and managing of photovoltaic solar power. The company’s products include power optimizers, inverters, and monitoring portals. It offers residential solutions, commercial solutions, and grid services.

Analyst Consensus Rating

Based on 13 Buys, four Holds, and one Sell, SolarEdge has a Moderate Buy consensus rating. SEDG’s average price target of $358.50 implies 40.4% upside potential from current levels.

Blogger Opinions

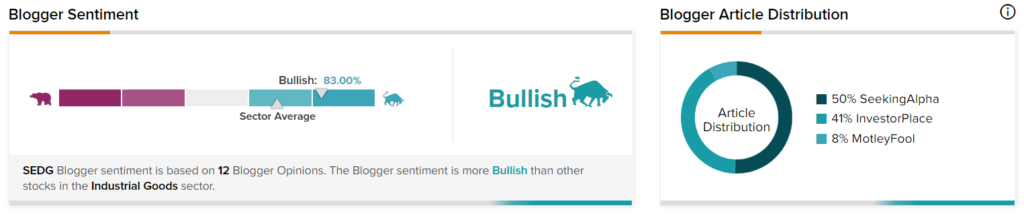

TipRanks data shows that financial blogger opinions are 83% Bullish on SolarEdge, compared to the sector average of 69%.

Conclusion

Following the announcement of the results after the market closed on Monday, SEDG stock gained 1.8% after hours after ending 1.96% higher at $255.31 in regular trading. This comes as a boost for the company whose shares have lost 27.7% over the past six months.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Lantheus Holdings EPS Surges Almost 20x; Shares Up

MGM Resorts to Acquire LeoVegas in Digital Gaming Push; Street Sees 33% Upside

Bristol Myers Turns Triumphant with Upbeat Q1 Results & Mavacamten Approval