SoFi Technologies (SOFI), a fintech and digital banking company, has surged nearly 100% year-to-date. The firm recently delivered strong Q3 results and lifted its full-year outlook, driven by steady growth in its member base and wider use of its financial products. Management now expects adjusted net revenue of $3.54 billion, up from $3.38 billion previously, and has raised its adjusted EPS forecast to $0.37 from $0.31. However, some investors remain cautious about the stock’s high valuation. With these updates in mind, let’s take a closer look at SOFI’s ownership profile using TipRanks’ Ownership tools.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

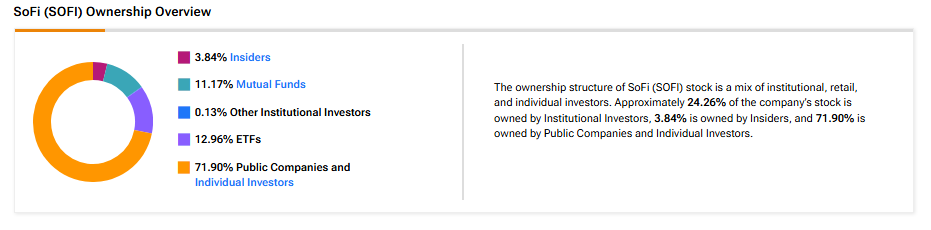

Now, according to TipRanks’ ownership page, public companies and individual investors own 71.90% of SOFI. They are followed by ETFs, mutual funds, insiders, and other institutional investors at 12.96%, 11.17%, 3.84%, and 0.13%, respectively.

Digging Deeper into SOFI’s Ownership Structure

Looking closely at top shareholders, Vanguard owns the highest stake in SOFI at 7.89%. Next up is Vanguard Index Funds, which holds a 7.67% stake in the company.

Among the top ETF holders, the Vanguard Total Stock Market ETF (VTI) owns a 2.97% stake in SoFi Technologies stock, followed by the Vanguard Small-Cap ETF (VB) with a 2.29% stake.

Moving to Mutual funds, Vanguard Index Funds holds about 7.67% of SOFI. Meanwhile, Fidelity Concord Street Trust owns 0.93% of the stock.

Is SOFI a Good Stock to Buy?

Currently, Wall Street has a Hold consensus rating on SoFi Technologies stock based on five Buys, seven Holds, and four Sell recommendations. The average SOFI stock price target of $28.29 indicates 6.82% downside potential.