Online personal finance company SoFi Technologies, Inc. (NYSE: SOFI) disclosed that it has concluded the acquisition of Golden Pacific Bancorp, Inc. and its wholly-owned subsidiary Golden Pacific Bank, National Association.

Shares of the company fell 8.4% on Wednesday and a further 4.1% at the time of writing.

Deal Details

The deal will help SoFi offer a more user-friendly interface, automated savings, as well as differentiated checking and savings accounts for easy budgeting. Further, the company will be offering an annual percentage yield of up to 1% for members, providing 33 times the national average interest on balances.

The acquisition was announced in March 2021, which was a key step in SoFi’s efforts to obtain a national bank charter. Recently, in January 2022, the company got approval from regulators.

With this transaction, Golden Pacific Bank has been renamed as SoFi Bank, National Association. Further, Golden Pacific Bank’s community bank business will now operate as a division of SoFi Bank, N.A.

Executive Comments

The CEO of SoFi, Anthony Noto, said, “This announcement reflects SoFi’s ongoing mission to help people achieve financial independence and realize their ambitions. Through this acquisition, Golden Pacific Bank members can expect an elevated digital and more robust mobile banking experience to serve local businesses and individual customers.”

“This new partnership will enhance our ability to provide the highest level of service while offering our customers a suite of products designed to help them get their money right,” said Virginia Varela, Golden Pacific Bank President and CEO.

Stock Rating

Recently, Rosenblatt Securities analyst Sean Horgan maintained a Buy rating on SoFi with a price target of $25 (105.6% upside potential).

Based on 7 Buys and 3 Holds, the stock has a Moderate Buy consensus rating. The SoFi price target of $20.30 implies 66.9% upside potential from current levels. Shares have declined 22.5% so far this year.

Website Traffic

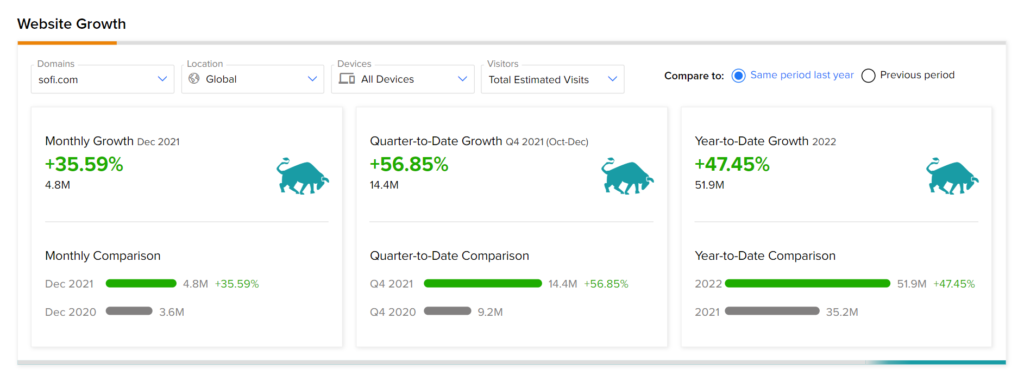

TipRanks’ Website Traffic tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into SoFi’s performance.

According to the tool, in December, SoFi’s website recorded a 35.6% monthly increase in global visits, compared to the previous year. Likewise, the website traffic has grown 47.5% year-to-date against the same period last year.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Boston Scientific Reports Strong Q4 Results

AbbVie Posts Mixed Q4 Results & Upbeat FY22 Outlook

Tenable Gains 4.6% on Better-Than-Expected Q4 Results