Snowflake Inc. (SNOW), a cloud-computing-based data warehousing company, reported triple-digit revenue growth backed by increased customer consumption but missed on earnings. Shares dipped 3.1% in the extended trading session on Wednesday.

Total revenue came in at $228.91 million, up 110% from the year-ago period, and surpassed the Street’s estimate of $212.89 million.

The company reported a loss of $0.70 per share, compared to a loss of $1.72 per share in the prior-year period. However, the loss was worse than the Street’s estimated loss of $0.16 per share. (See Snowflake stock analysis on TipRanks)

Product revenue increased 110% at $213.8 million, and remaining performance obligations (RPO), which is the amount of contracted future revenue not yet recognized, were up 206% year-over-year at $1.4 billion. At the end of April, the company reported a net revenue retention rate of 168%, and a total of 4,532 customers of which 104 customers have a trailing 12-month product revenue greater than $1 million.

Pleased with the results, the company’s CEO Frank Slootman said, “Snowflake reported strong Q1 results with triple-digit growth in product revenue, reflecting strength in customer consumption…Remaining performance obligations showed a robust increase year-on-year, indicating strength in sales across the board.”

In the upcoming quarter, the company projects Product revenue in the range of $235 – $240 million with a 19% operating loss margin.

For FY22, the company forecasts Product revenue to be in the range of $1.02 – $1.04 billion with a 17% operating loss margin.

The Street’s consensus estimate for total revenue is pegged at $251 million for Q1 and $1.09 billion for FY22.

Anticipating a solid set of Q1 results, Piper Sandler analyst Brent Bracelin said, “We expect few major surprises when SNOW reports this week (5/26). That said, another quarter of triple-digit cRPO growth would suggest: 1) Snowflake remains one of the fastest growing enterprise-scale software firms, 2) fundamentals are quickly growing into the premium valuation, and 3) broader Fortune 100 adoption reinforces the potential for Snowflake to become a de facto data platform.”

Bracelin maintains a Buy rating on the stock with a price target of $312, which implies 32.6% upside potential to current levels.

The Wall Street community is cautiously optimistic about the stock with a Moderate Buy consensus rating. That’s based on 10 Buys versus 11 Holds. The average analyst price target of $280.24 implies 19% upside potential to current levels. Shares have lost 15.5% year-to-date.

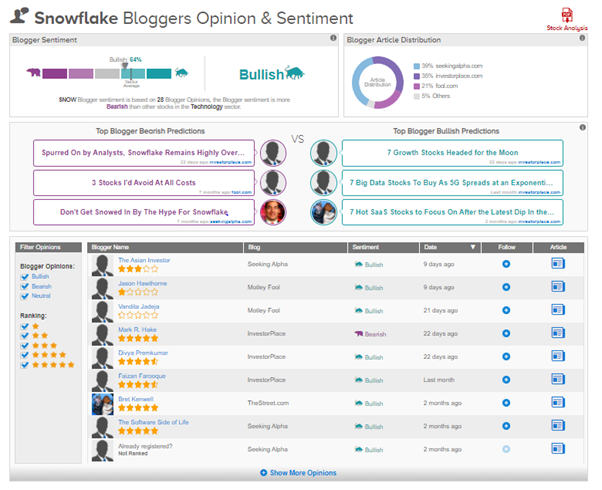

TipRanks data shows that financial blogger opinions are 64% Bullish on SNOW, compared to a sector average of 69%.

Related News:

NVIDIA’s Q1 Profit Jumps 103% as Gaming, Data Center Revenue Boom

Abercrombie & Fitch Delivers Strong Q1 Results; Shares Pop 8%

Insperity Bumps up Quarterly Dividend By 12.5%; Shares Up 2%