Shares of SmartRent (NYSE: SMRT) were down around 10% during extended trading on March 24, after the smart home automation company, which develops software and hardware for property owners, managers, and homebuilders, reported mixed Q4 results.

Further, investors were disappointed by FY2022 guidance issued by the company, which fell below consensus expectations.

Mixed Q4 Numbers

Positively, revenues jumped 155% year-over-year to $34.7 million, and exceeded consensus estimates of $31.4 million.

The increase in revenues reflected a surge in annualized software as a service (SaaS) annual recurring revenue, which increased 114% to $10.6 million.

Despite its top-line growth, the company reported an adjusted loss of $0.13 per share, which fell four cents short of the street’s estimated loss of $0.09. However, it was a significant improvement over the previous year’s loss of $1.03 per share.

FY2022 Outlook

Based on the company’s current expectations of robust demand for its product, execution capabilities, and market conditions, management provided financial guidance for FY2021.

For FY2022, revenues are forecast to be in the range of $220 million to $250 million, lower than the consensus estimate of $301 million. For the first quarter, revenues are projected to be in the range of $35 million to $37 million.

CEO Comments

SmartRent CEO, Lucas Haldeman, commented, “In 2022, we’re looking forward to continuing to build on our strong foundation and solidify our position as the market leader in enterprise smart home solutions.”

He further added, “We have sufficient capital resources to support our organic growth and incremental external growth initiatives.”

Wall Street’s Take

Following mixed Q4 results, Morgan Stanley analyst Erik Woodring decreased the price target on SmartRent to $6.80 from $9, but reiterated a Hold rating.

Consensus among analysts is a Strong Buy based on four Buys and one Hold. The average SmartRent stock price projection of $10.56 implies 67.62% upside potential to current levels, at the time of writing.

Investors Weigh In

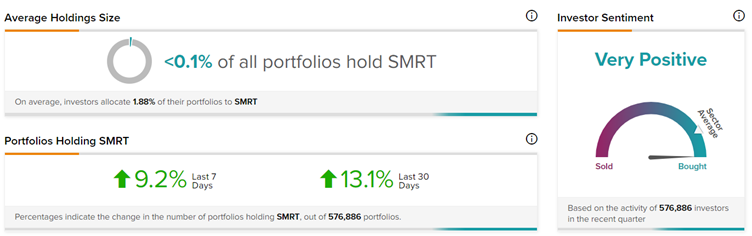

Markedly, on the contrary, TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on SmartRent, with 9.2% and 13.1% of investors increasing their exposure to SMRT stock over the past seven days and 30 days, respectively.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Clear Secure Reports Quarterly Beat; Shares Up 16.8%

Winnebago Industries Shares Tank 11.8% Despite Q2 Beat

Traeger Shares Dip 20% on Muted FY22 Outlook Despite Q4 Beat