Sleep Country Canada (TSE:ZZZ), a retailer of mattresses and other sleep products, reported its Q4-2022 and full-year earnings results earlier today. ZZZ’s results beat both revenue and earnings-per-share (EPS) expectations, although things have slowed down compared to last year.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Sleep Country’s revenue fell to C$243 million (a 10.4% year-over-year decline), which beat expectations of C$238 million. Likewise, Sleep Country’s Q4 same-store sales declined 11.5%.

Additionally, its adjusted diluted earnings per share fell 19.3% year-over-year to C$0.67, but this was still ahead of the C$0.64 consensus estimate. Also, the company’s operating EBITDA margin was 21.8% compared to 22.9% last year, while operating EBITDA fell 11.5% to C$50.7 million, but its gross profit margin increased by 150 basis points to 37.5%.

Lastly, in Q4, Sleep Country bought back C$22 million worth of its shares, representing 2.6% of its market cap.

Full-Year Results

On a full-year basis, revenues actually increased slightly by 0.9%, reaching C$928.7 million. However, e-commerce as a percentage of revenue fell from 23.5% to 19.6%. Meanwhile, adjusted earnings per share grew by 6.4%, reaching C$2.81, as the first half of 2022 was clearly stronger than the back half, and the company’s gross profit margin increased by 220 basis points to 36.7%. Further, EBITDA came in at C$210.5 million, a 5.5% increase year-over-year, and to top things off, share repurchases totaled C$57.7 million.

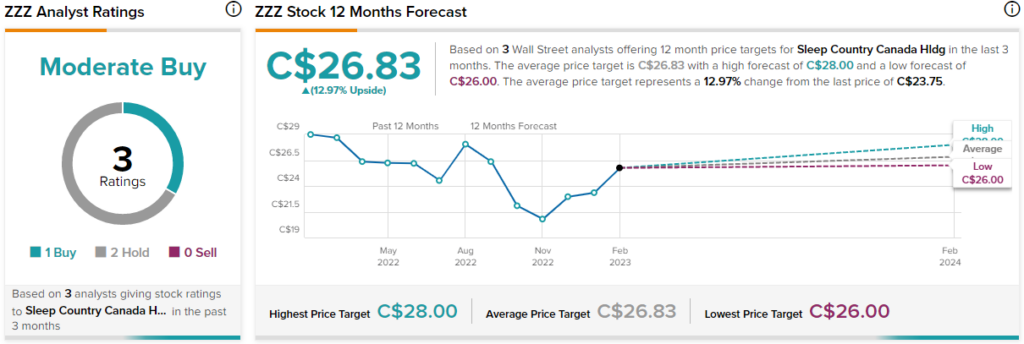

Is Sleep Country Stock a Buy, According to Analysts?

Sleep Country stock sports a Moderate Buy consensus rating based on one Buy and three Holds assigned in the past three months. The average Sleep Country stock price target of C$26.83 implies 13% upside potential.