Shares of Sierra Wireless Inc (SW) rose as much as 10% on Friday morning after the company reported a better-than-expected adjusted profit in its first quarter. Sierra Wireless provides IoT solutions that combine devices, network services, and software to unleash value in the connected economy.

Total revenue came in at $108.1 million for the quarter ended March 31, up 4.9% year-on-year and beating the Zacks Consensus Estimate by 5.47%. The increase in revenue was mainly driven by Connectivity, Software, and Services revenue which rose 26% to $33.7 million.

Meanwhile, the wireless broadband modem maker reported a net loss of $29.9 million in Q1 2021 ($0.81 per share), compared to a net income of $22.7 million ($0.62 per share) in Q1 2020.

Adjusted for one-time gains and costs, the loss was $0.26 per share in the first quarter, better than the loss of $0.53 per share reported in the prior-year quarter. The average estimate among analysts polled by Zacks Investment Research was for a loss of $0.27 per share.

Sierra Wireless’ President and CEO Kent Thexton said. “Demand for our Internet of Things (“IoT”) products and gateways remains strong with Q1 orders up over 30% year over year, and we are working closely with all our supply chain partners to build and ship our products to our customers. The requirement for real-time monitoring of assets and advanced edge processing is growing in importance as more industrial and enterprise companies are digitizing their assets. With our IoT devices, connectivity service and edge-to-cloud tools, Sierra Wireless is the trusted supplier for IoT solutions.”

For the second quarter of 2021, Sierra Wireless expects its revenue to be between $118 million and $122 million. (See Sierra Wireless Inc stock analysis on TipRanks)

Yesterday, Canaccord Genuity analyst Michael Walkley maintained a Buy rating on SW with a price target of $26.00 (C$31.64) for 78.7% upside potential.

Overall, consensus on the Street is that SW is a Hold based on 3 Buys, 4 Holds, and 2 Sells. The average analyst price target of C$23.93 implies 34.2% upside potential from current levels. Shares have risen 60% over the last year.

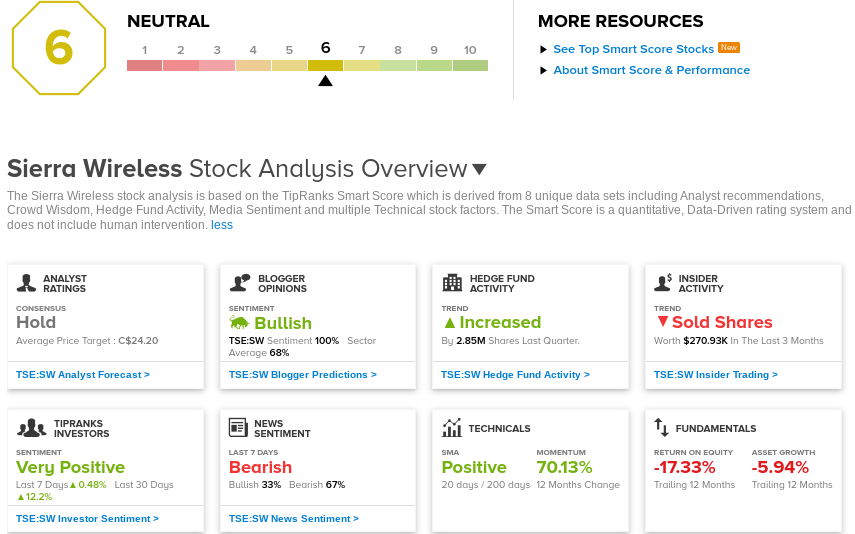

TipRanks’ Smart Score

SW scores a 6 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock’s returns are likely to perform in line with the market.

Related News:

Power Corp Q1 Profit Nearly Triples, Beat Estimates

Quebecor Reports Slight Drop in Profits, Higher Revenues in Q1

TMX Group Posts Better-Than-Expected 1Q Results, Boosts Dividend 10%