Energy technology company Siemens Energy (SMEGF) stock tanked over 24% on Friday after the company pulled back its profit forecast for Fiscal 2023. The primary factor behind this decision is the emergence of severe quality issues in Siemens’ wind turbine division. A revamp of the system is expected to cost more than $1.09 billion.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The company conducted an extensive technical examination of the turbine fleet and product designs implemented by its subsidiary, Siemens Gamesa Renewable Energy. During this review, the company discovered that certain components of the wind turbines, including bearings and blades, were experiencing accelerated wear and tear, surpassing initial expectations in terms of their durability.

Furthermore, the company is estimating that the identified issues are likely to affect approximately 15% to 30% of the installed onshore wind turbine fleet.

It is worth noting that in January, Siemens incurred maintenance charges amounting to approximately €500 million following an initial review of Siemens Gamesa, which revealed faults in the components.

Analysts Weigh In

Despite Siemens’ expectations of such a huge outlay in the near term to address the issues with their wind turbines, four analysts maintained a Buy rating on the stock, while one reiterated a Sell rating. Moreover, three analysts assigned the stock a Hold rating today.

Among the bullish analysts, Goldman Sachs analyst Ajay Patel holds the view that the company’s shares of Siemens Gamesa may continue to be negatively impacted by the uncertainty surrounding the true extent of the problem and concerns regarding the company’s balance sheet. Additionally, Patel anticipates that further insight into this matter will be provided during Siemens’ Q3 earnings announcement, which is slated for August 7th.

Nevertheless, Patel remains impressed by the improved performance of the company’s gas & power businesses. Importantly, his price target of $34.60 on Siemens stock implies an upside potential of 116.8%.

What is Siemens’ Price Target?

Turning to Wall Street, Siemens has a Strong Buy consensus rating based on 11 Buys, one Hold, and one Sell assigned in the past three months. At $30.13, the average Siemens stock price target implies 88.78% upside potential.

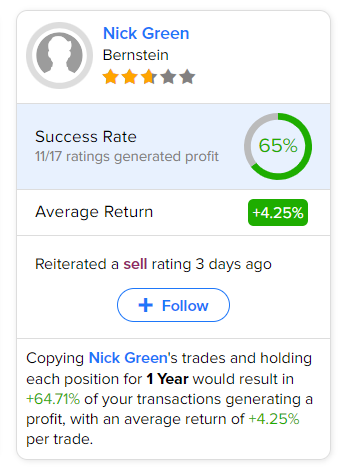

Remarkably, Bernstein analyst Nick Green is the most accurate and profitable analyst for SMEGF. Copying the analyst’s trades on this stock and holding each position for one year has resulted in 65% of transactions generating a profit, with an average return of 4.25% per trade.