Heading into the last week of 2020, a year that witnessed an unprecedented pandemic, the S&P 500 is up 14.6% year-to-date. Among the stocks that have significantly outperformed the broader market this year are two e-commerce players, Shopify and Wayfair. Both stocks have risen by triple digits this year, but will the rally continue?

With COVID-19 vaccines being rolled out, certain analysts believe that “stay-at-home” stocks might not continue to benefit from pandemic-induced tailwinds, and the revenue growth of these companies could slow down next year. With the help of TipRanks’ Stock Comparison tool, we will place Shopify and Wayfair alongside each other and find out which stock is poised to keep climbing higher.

Shopify (SHOP)

Amid the pandemic, several merchants turned to e-commerce to sell their products and Shopify provided the platform to do so. In 3Q alone, Shopify’s revenue jumped 96% year-over-year to $767.4 million and helped the company flip to adjusted EPS of $1.13, compared to a loss of $0.29 in the prior-year quarter. Gross Merchandise Value (GMV), which indicates the total value of orders facilitated through the Shopify platform, surged 109% to $30.9 billion in 3Q.

To make its platform more attractive for merchants, the company has been taking several initiatives including enhancing its fulfillment network, expanding the Shopify Payments facility to additional markets and rolling out products like ‘buy now, pay later’, which enables merchants to offer their customers more payment choices and flexibility at checkout.

Last month, Jefferies analyst Samad Samana upgraded Shopify to Buy from Hold and raised the price target to $1,250 from $1,150, as he believes that the company’s long-term prospects are bright. In a note to investors, Samana stated, “We have a greater appreciation for SHOP’s ability to deliver robust growth for the next several years and reach about $10 billion of revenue in 2025, powered by a structural pull-forward in e-commerce activity and better monetization of [gross merchandise value].”

Samana expects Shopify to sustain strong GMV growth in the fourth quarter, driven by holiday shopping. (See SHOP stock analysis on TipRanks)

He points out that the COVID-19 pandemic has exacerbated structural issues for both online and offline merchants like “the challenge of selling across multiple channels, the difficulty of logistics, the need to access capital, to name a few.” Samana believes that Shopify addresses many of these “pain points” and expects more merchants to adopt the company’s platform and existing merchants to increasingly utilize its merchant solutions.

Shopify shares have skyrocketed about 208% year-to-date. Unlike Samana, who sees further upside in the stock, Susquehanna analyst John Coffey believes that shares might be fully valued. Coffey initiated coverage of Shopify earlier this month with a Hold rating and a price target of $950 (downside potential of 23.2%). The analyst expects the company’s revenue growth to decelerate in 2021, assuming a return to more normalized business conditions.

Overall, the Street is cautiously optimistic about the stock, with 11 Buys, 9 Holds and 1 Sell adding up to a Moderate Buy analyst consensus. Given the stellar rise so far, the average price target of $1,169.35 implies that the stock could fall 4.4% from current levels.

Wayfair (W)

Mastercard SpendingPulse released its holiday sales report on December 26, with it revealing two key trends—strength in online sales amid the current health crisis and double-digit growth in the home improvement and home furniture & furnishings categories. Both trends look favorable for online home furnishings retailer Wayfair.

The e-commerce retailer swung to a profit of $2.30 per share in 3Q from an adjusted loss per share of $2.23 in the prior-year quarter, thanks to the 66.5% rise in revenue to $3.84 billion. Through its portfolio of sites—Wayfair, Joss & Main, AllModern, Birch Lane and Perigold— the company attracted more customers amid the pandemic as stay-at-home and remote working mandates boosted the sales of home goods.

The number of active customers in the company’s Direct Retail business reached 28.8 million as of Sept. 30, reflecting a 50.9% year-over-year rise. (See W stock analysis on TipRanks)

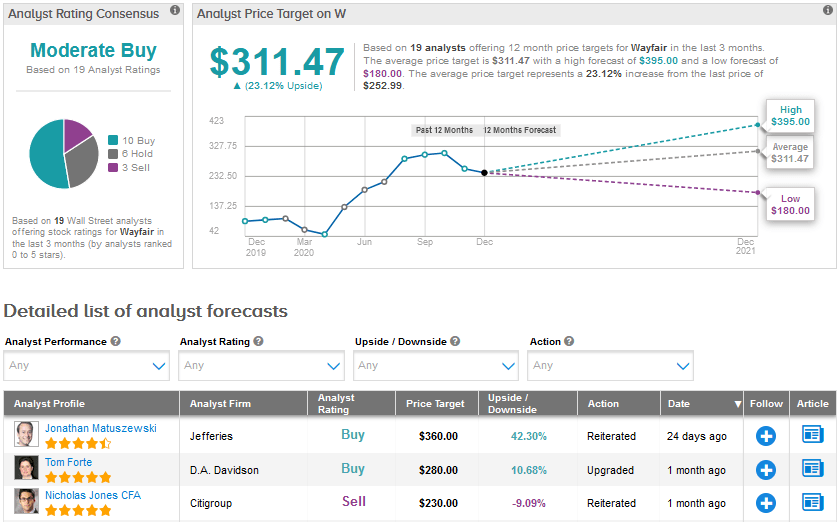

The news of COVID-19 vaccines had an unfavorable impact on the stock, though it is still up by a whopping 180% so far this year. Recently, D.A. Davidson analyst Tom Forte upgraded his rating on Wayfair to Buy from Hold with a $280 price target, saying that he was “taking advantage of the pullback to upgrade shares of W.”

Forte acknowledged that Wayfair gained from the pandemic. However, he believes that there are sustainable benefits that will outlast the COVID-19 crisis. The 5-star analyst finds the stock attractive due to Wayfair’s “now proven ability to generate profitable sales growth,” and feels that its gross margins will be “sustainably higher” in the future.

Citigroup analyst Nicholas Jones also increased his price target for Wayfair to $230 from $225 last month but reiterated a Sell rating. Jones continues to see risk in the company’s ability to sustain both its growth trajectory and profitability as pandemic-induced restrictions wane and a more normalized competitive environment returns.

On the 3Q conference call, Wayfair’s management did admit that “as the environment further normalizes, there’ll be some volatility period-to-period.” That said, the company is focused on long-term growth and feels that the $800 billion total addressable market in North America and Europe for the home category is underpenetrated. It aims to capture the demand across mass and luxury demographics with its portfolio of e-commerce sites and extensive offerings.

Overall, the Street’s cautiously optimistic Moderate Buy consensus rating on Wayfair is based on 10 Buys, 6 Holds and 3 Sells. The price target stands at $311.47 and indicates further upside potential of 23.1% over the coming year.

Conclusion

Wayfair and Shopify have significantly benefited from the accelerated shift to e-commerce. They are expected to continue to gain from the rising preference for online shopping, though certain analysts have concerns about the pace of growth in the quarters ahead. Currently, Wayfair stock seems to look more favorable than Shopify based on the upside potential in the months ahead.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment