Shares of Shopify Inc. (NYSE: SHOP) bounced back 6.4% to close at $938.49, after the company eased lingering concerns by stating that proposed changes will be made to Shopify Fulfillment Network (SFN), which will help merchants compete with big-box retailers by enabling shipping at affordable prices.

Shopify Inc. is a Canadian multinational e-commerce company that provides infrastructure for online retailers to set up their stores online through a suite of services including payments, marketing, shipping, and customer engagement tools.

Shopify Affirms Zero Reduction In Capacity

Shopify confirmed that the proposed changes will not lead to capacity reduction and the same has been informed to its warehouse partners and merchants. The company further added that it had ample capacity to meet the fulfillment needs of its merchants via the SFN.

SFN is essentially an in-house fulfillment network that enables merchants on the platform to ensure enhanced and speedy deliveries at low costs.

Further details on the proposed changes to the fulfillment network will be revealed at the company’s upcoming earnings for the fourth-quarter scheduled to be held on February 13.

Shopify: Why Share Price Loss Last week?

On January 21, Shopify shares were down 14%, after news broke that the e-commerce company had terminated or reduced contracts with several warehouses and fulfillment partners.

Probable huge investments raised doubts in the minds of investors as it implied the business may switch from an asset-light model to owning capital-extensive distribution centers.

Notably, Shopify was one of the major beneficiaries of the adoption of e-commerce by retailers, food brands, and other businesses during the COVID-19 pandemic. Shares have surged over 200% in the last 2 years, making it one of Canada’s top stocks. However, shares have also lost 22% over the past year.

Management Commentary

On January 24, the company officials stated, “We will be making changes to the SFN (Shopify Fulfillment Network) to help merchants compete with big-box retailers, such as prioritizing two-day shipping at affordable prices and access to easy returns for U.S. shoppers”.

Further, the company confirmed that, “Capacity will not be reduced, and we do not anticipate disruptions to our merchants’ fulfillment.”

Wall Street’s Take

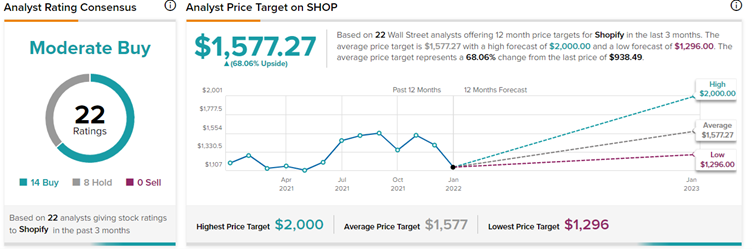

On January 24, Wedbush analyst Ygal Arounian decreased the price target on Shopify to $1,296 (38.1% upside potential) from $1,500 and reiterated a Buy rating.

Arounian stated that his channel checks confirmed the news on contracts termination with many of its partners. The analyst stated that he was anticipating the news as Shopify’s partnerships did not yield the advantage it was hoping for.

The rest of the Wall Street community is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on 14 Buys and 8 Holds. At the time of writing, the average Shopify stock forecast was $1,577.27, which implies a 68.1% upside potential to current levels.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Will Peloton Become the Next M&A Target?

Schlumberger Posts Upbeat Q4 Results

Diversey Holdings Acquires Shorrock Trichem