Shares in oil giant Shell (SHEL) were less slick today despite reportedly getting set to challenge its defeat in an arbitration case against U.S. liquefied natural gas producer Venture Global in the New York Supreme Court.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Overturn Move

According to a report on Reuters and later confirmed by Shell, the company will look to overturn the case it lost in August against Venture Global. It is a U.S.-based LNG exporter focused on developing and operating large-scale LNG facilities, including the Calcasieu Pass and Plaquemines projects.

The arbitration case was over Venture Global’s alleged failure to deliver liquefied natural gas under long-term contracts starting in 2023. Shell alleges in the new filing that Venture Global withheld information from Shell and the arbitration tribunal.

Shell, and other firms including rival BP (BP), Edison and Galp, filed arbitration claims starting in 2023, accusing Venture Global of profiting from the sale of LNG on the spot market while not providing the firms with their contracted cargoes from the Calcasieu Pass export facility in Louisiana.

Shell’s move to challenge the decision likely comes in the wake of rival BP winning a similar $1 billion-plus arbitration decision last month.

Failed Obligations

According to a regulatory filing, the International Chamber of Commerce’s Court of Arbitration ruled that Venture Global failed to meet its obligations by not declaring commercial operations at its Calcasieu Pass plant on time and not acting as a “reasonable and prudent operator.”

At the time, Venture Global said it was disappointed by the arbitration decision, arguing that it contradicts earlier findings in the Shell case.

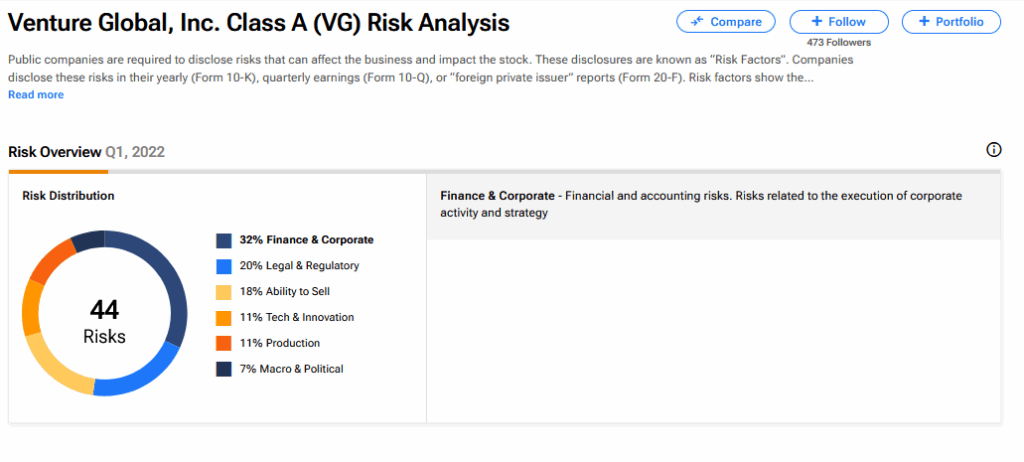

Venture’s share price collapsed after the BP decision, but it is up over 1% today. However, the regulatory rumblings have shown how legal action is such a key risk for the business and for investors looking to add the stock to their portfolio.

See our handy Risk Analysis tool reading for Venture Global above.

What are the Best Oil Stocks to Buy Now?

We have rounded up the best oil stocks to buy now using our TipRanks comparison tool.