Global oil and gas giants, Shell (NYSE:SHEL)(GB:SHEL) and Exxon Mobil (XOM) have initiated a sale process of certain offshore natural gas assets in the southern UK and Dutch North Sea regions.

The sale of the said assets is expected to generate more than $2 billion. Over the coming days, the company expects bids for the assets from various oil and gas companies with a known interest in the initial processes.

Notably, this is not the first time the oil and gas majors have launched the sale of their assets in the UK and Europe. Both companies have run sales of their other assets independently as well as on a combined basis earlier this year.

In July, both Shell and Exxon announced the sale of their equal NAM JV in the Netherlands, which is one of the largest and oldest natural gas production sites in Europe.

In fact, two days ago, Shell exited Ireland, moving out of the two planned offshore wind projects with Simply Blue Group, citing regulatory hurdles.

Is Shell Profitable?

Shell stock has consistently grown its profits and has indeed beaten the street’s earnings expectations in six out of the eight preceding quarters.

For Q3, Shell’s EPS is expected to grow more than 2.5x to $2.85 compared to $1.06 reported in the prior-year quarter. Shell is scheduled to report its Q3 results on October 27.

Based in the UK, Shell is a global group of energy and petrochemical companies with expertise in the exploration, production, refining, and marketing of oil and natural gas and the manufacturing and marketing of chemicals.

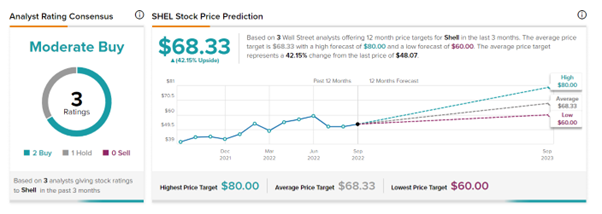

On TipRanks, analysts are cautiously optimistic about the SHEL stock and have a Moderate Buy consensus rating, which is based on two Buys and one Hold. Shell’s average price forecast of $68.33 implies 42.15% upside potential from current levels.

Ending Thoughts

With the volatility in the underlying oil prices, asset sales by both companies are driven by cost-cutting goals as well as disposal of older assets to fund the building of newer and more profitable projects globally.

Read full Disclosure