General Atlantic and Sequoia Capital, two major investors in TikTok’s Chinese parent company, are reportedly pushing Oracle’s bid to buy the US operations of the popular video-sharing app as it seeks to avoid a ban by the Trump administration.

The investment firms, which own large stakes in Beijing-based ByteDance Ltd., are key drivers behind a possible bid for TikTok by a group including Oracle, the Wall Street Journal reported. The Oracle group (ORCL) emerged recently as a possible contender to Microsoft, which is touted as the frontrunner to buy TikTok’s operations in the US and three other countries.

Microsoft (MSFT) had said it might ask some US investors to join its bid. However, according to the Wall Street Journal, Sequoia and General Atlantic recently grew concerned that they wouldn’t be included in a Microsoft deal and looked for another potential tech partner that could give them a piece of the action. They are now backing the potential Oracle bid, which quickly won President Donald Trump’s public support.

Sequoia and General Atlantic both hold seats on ByteDance’s board. Sequoia’s seat is occupied by its China head, Neil Shen, while its efforts in the US to participate in an acquisition are being led by Global Managing Partner Doug Leone. General Atlantic’s effort is led by its CEO, Bill Ford, who represents his firm on ByteDance’s board.

ByteDance has been under pressure to reach a deal to sell TikTok’s US arm ahead of a 90-day deadline the White House imposed this month for any deal to be completed or for the app to face a ban. The Trump administration has said that the app poses an economic and national-security threat to US interests, if it isn’t sold to US buyers.

Oracle shares have advanced 3.7% in the past 5 days taking their year-to-date gain to 5.7%. (See ORCL stock analysis on TipRanks).

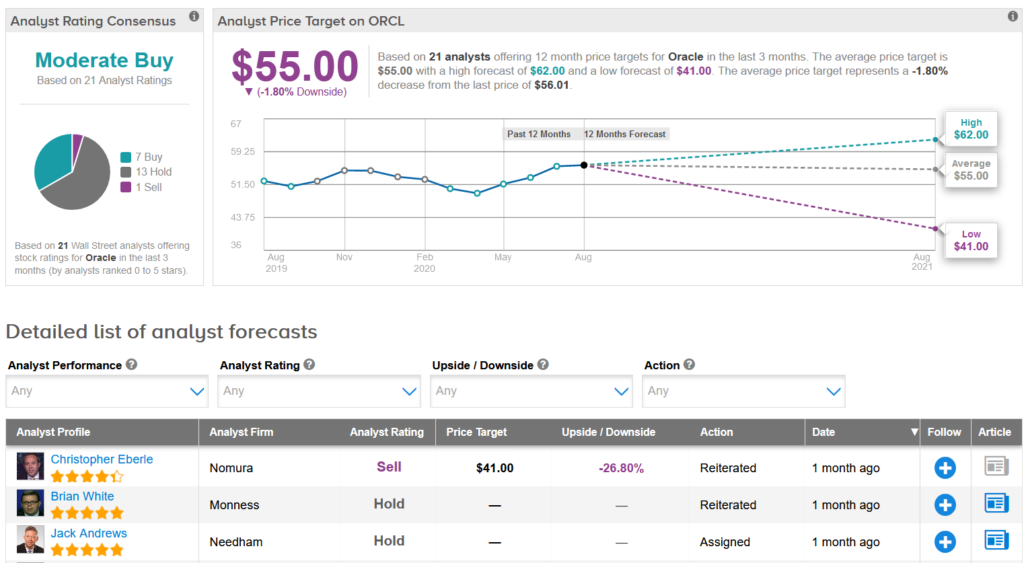

Meanwhile, Monness analyst Brian White last month reiterated a Hold rating on the stock after Oracle disclosed expanded cloud customer offerings and a new autonomous service.

“We believe Oracle offers a valuable, differentiated cloud proposition; however, the company has been unable to string together consecutive quarters of strong performance (even in good times) and we expect its cloud push will take more time to monetize,” White wrote in a note to investors.

Overall, Wall Street analysts are cautiously optimistic on the stock split between 7 Buys, 13 Holds and 1 Sell, which gives the stock a Moderate Buy consensus. Looking ahead, the average analyst price target of $55 implies 1.8% downside potential to the current share price.

Related News:

AstraZeneca Rises On Report Trump Could Fast-Track Covid-19 Vaccine Candidate

Merck Wins 2 Approvals For Keytruda Therapy In Japan

Medtronic Ramps Up Dividend By 7% Ahead Of 1Q; Analyst Sticks To Buy