Shares in Scotts Miracle-Gro Co. (SMG) are soaring 6% in pre-market trading after the lawn product company revised its sales and earnings guidance upwards due to higher product demand.

The stock jumped 6% to $147.70 in pre-market trading after Scotts Miracle-Gro said that for the fiscal year ending September 30, it now expects sales growth of 16% to 18% versus the 6% to 8% guidance provided in May.

Higher sales estimates are driven mainly by stronger growth in its U.S. consumer segment, where the company sees growth of 9% to 11%, compared with its previous range of 1% to 3%. In addition, Hawthorne sales are forecast to grow 45% to 50% for the full year, compared with a recent increase in guidance of 30% to 35%.

The revised guidance comes as an “unprecedented number of consumers are planting and maintaining gardens”, the company said. As a result, adjusted non-GAAP earnings are expected to be in a range of $5.65 to $5.85 per share, up from previous guidance of $4.95 to $5.15 per share.

“It is both exciting and humbling to witness what is happening in our U.S. Consumer business,” said Jim Hagedorn, chairman and CEO at Scotts Miracle-Gro. “Consumer purchases of our products at our largest four retail partners were up 44% in May, and we are now up approximately 19% year-to-date at the time of this announcement.”

The company added that it has seen a 40% increase in purchases of its branded soils and more than a 30% rise of its plant food sales as well as strong demand for outdoor and indoor pest control products.

For fiscal 2020, it expects to incur $30 to $35 million in one-time expenses, which include COVID-19 related incremental costs due to premium pay adjustments that were given to front-line associates who work in the sales force as well as manufacturing and distribution facilities and certain one-time cleaning costs.

Its non-GAAP adjusted gross margin rate is estimated to be flat to slightly lower on the year as the strength in Hawthorne has a dilutive impact on the company-wide rate. However, both the U.S. consumer and Hawthorne segments are expected to see year-over-year gross margin rate improvements.

Non-GAAP free cash flow, calculated as GAAP operating cash flow minus capital expenditures, is now expected to amount to $350 million.

The stock has almost doubled in its value after reaching this year’s low in March and is trading about 32% higher than in the beginning of the year.

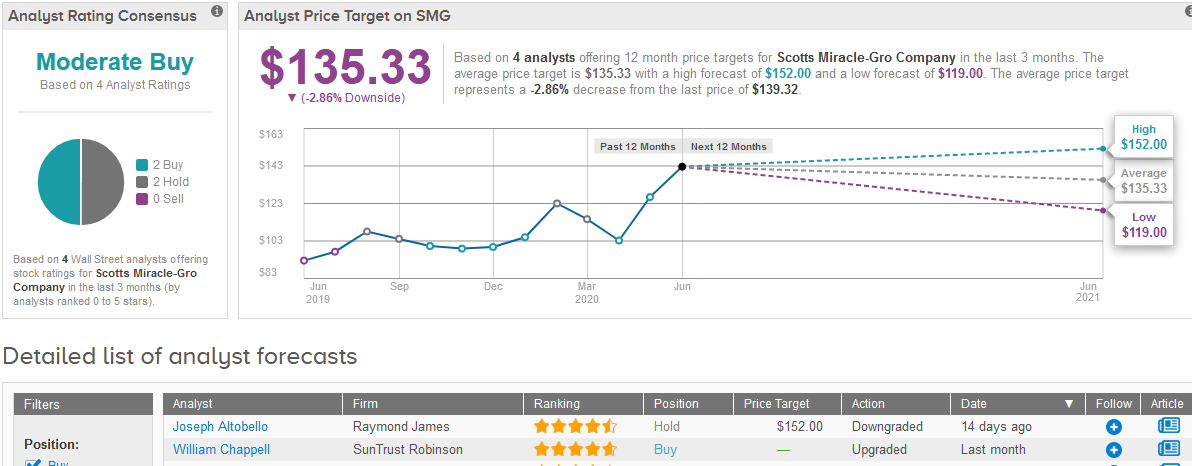

Five-star analyst Joseph Altobello at Raymond James late last month cut the stock to Hold from Buy with a $152 price target, saying the stock’s near-term rally has “largely played out”.

Altobello believes that stay-at-home orders helped boost sales and earnings in fiscal Q2 and May, but he doesn’t see the same performance continue going forward.

The rest of the Street’s rating outlook for the stock is currently split evenly between 2 Buys and 2 Holds adding up to a Moderate Buy consensus. The $135.33 average analyst price target implies 2.9% downside potential in the coming 12 months. (See SMG stock analysis on TipRanks)

Related News:

Dunkin’ Franchisees To Hire 25,000 Workers As U.S. States Reopen; Keybanc Raises Stock To Buy

Grubhub Shares Lifted On Report Of European Acquirers Lining Up

Starbucks Back To Business In Japan