Science Applications International delivered better-than-anticipated earnings for the third quarter of fiscal 2021 (ended Oct. 30) but lagged analysts’ revenue estimates. Shares rose 3.3% on Dec. 4.

The professional services and IT contractor generated third-quarter revenue of $1.82 billion, which grew 11.5% year-over-year but missed analysts’ estimate of $1.83 billion. Science Applications’ (SAIC) third-quarter revenue benefited from the acquisition of Unisys Federal, revenue on new contracts mainly supporting the U.S. Air Force, and higher volumes on existing programs. However, the COVID-19 pandemic had a $60 million adverse impact on 3Q programs.

Meanwhile, the 3Q adjusted EPS increased about 16.5% year-over-year to $1.62, exceeding analysts’ estimate of $1.53. The quarter’s earnings growth was driven by operating margin expansion, reflecting the impact of the Unisys Federal acquisition and lower indirect costs.

The company has now updated its FY21 guidance and expects revenue of $7.10 billion-$7.15 billion, compared to the prior outlook of $7.1 billion-$7.2 billion. It expects adjusted EPS of $5.95-$6.05, versus the previous guidance range of $5.80-$6.10. (See SAIC stock analysis on TipRanks)

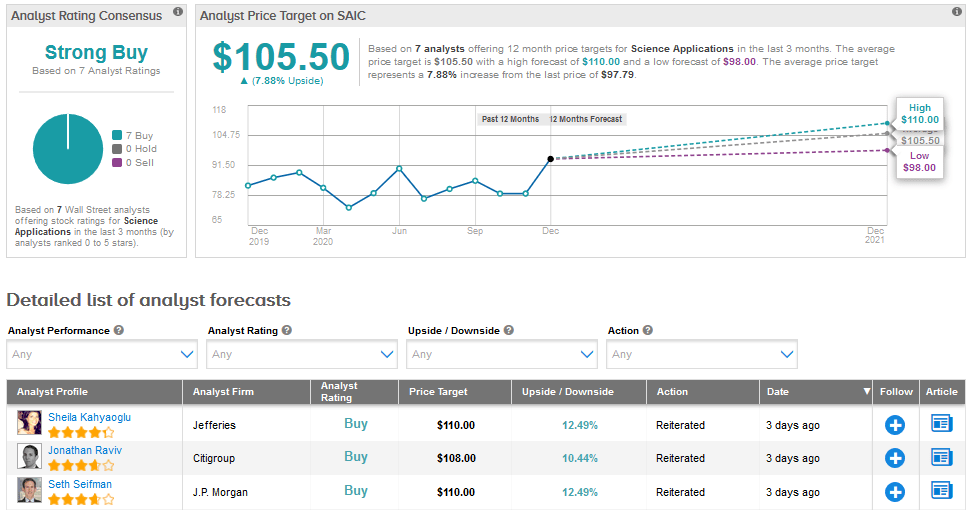

Following the print, Cowen analyst Cai Rumohr reiterated a Buy rating on Science Applications with a price target of $105 and stated, “Investors should like SAIC’s blowout book-bill & free cash flow as well above-consensus adj. EPS and slightly hiked FY21 guide. These likely will outweigh slightly light organic revenues.”

The Street mirrors Rumohr’s bullish sentiment, with a Strong Buy analyst consensus based on 7 unanimous Buys. With shares rising 12.5% year-to-date, the average price target of $105.50 implies an upside potential of about 8% from current levels.

Related News:

American Airlines Expects 4Q Daily Cash Burn At ‘High End’; Shares Rise

Boeing 737 Max Europe Flying Ban Seen Lifted In January – Report

Nasdaq To Snap Up Verafin For $2.75B In Fraud Detection Push