SAP SE shares rose 4.9% in extended-hours trading on Wednesday after the German software giant’s cloud business registered its fastest growth in the past five years in the first quarter of 2021. The company’s cloud revenue was €2.14 billion, up 7% year-on-year while current cloud order backlog was €7.63 billion, a rise of 15% year-on-year.

SAP SE’s (SAP) CEO Christian Klein said, “We are seeing very strong growth across all our applications. And we are just getting started. Our new offering ‘RISE with SAP’ is rapidly becoming a massive accelerator to our customers’ business transformations with our platform at the center. Together with our unique ecosystem of more than 22,000 partners and with a strong innovation pipeline for the year, we are well on track with our strategy to deliver robust cloud growth.”

The company also posted the strongest increase in non-IFRS operating profit and margin in a decade with growth of 24% and 4.9% at constant currencies, respectively. Non-IFRS operating profit was €1.74 billion with an operating margin of 27.4%. IFRS EPS was up 29% year-on-year to €0.88.

SAP’s CFO, Luka Mucic said, “In the mid term SAP’s expedited shift to the cloud will accelerate topline growth and significantly increase the resiliency and predictability of our business.”

SAP also raised its financial outlook for FY21 as the company assumes “the COVID-19 crisis will begin to recede as vaccine programs roll out globally, leading to a gradually improving global demand environment in the second half of 2021.”

The company now expects FY21 non-IFRS cloud revenues on a constant currency basis to be between €9.2 billion and €9.5 billion from the earlier expected range of €9.1 billion to €9.5 billion. SAP also anticipates non-IFRS operating profit at constant currencies to land between €7.8 billion to €8.2 billion, down year-on-year by 1% to 6%. (See SAP SE stock analysis on TipRanks)

SAP expects the share of total cloud and software support revenue to be around 75% in FY21 from a share of 72% in FY20.

On April 9, Societe Generale analyst Richard Nguyen lowered the price target from €138 to €136 and reiterated a Buy on the stock.

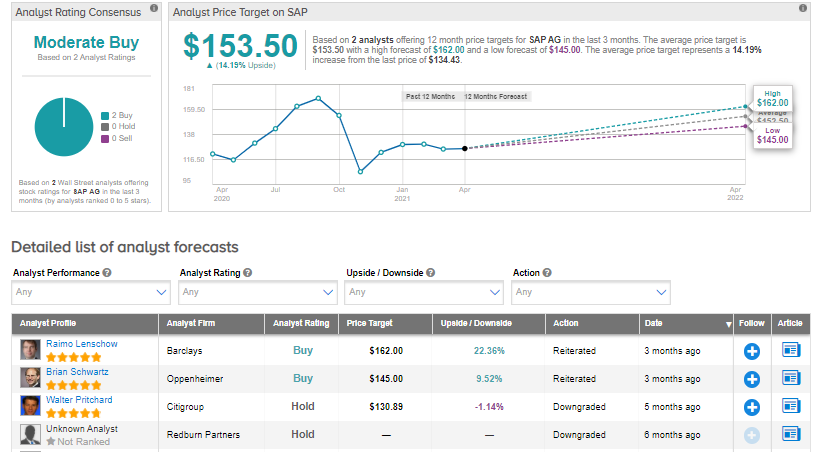

Wall Street currently rates SAP as a Moderate Buy based on 2 Buys. An average analyst price target of $153.50 implies 14.2% upside potential from current levels.

Related News:

Beyond Meat To Expand Product Distribution Across Europe

Uber Reports Record Gross Bookings Of $30B In March

Nvidia Gives Key Investor Day Updates; 1Q Revenue Tracking Above $5.3B 1Q Outlook