Samsung Electronics (SSNLF) has scored a $6.64 billion order to provide Verizon’s (VZ) wireless communication solutions in the United States, according to a report from Reuters.

“With this latest long-term strategic contract, we will continue to push the boundaries of 5G innovation to enhance mobile experiences for Verizon’s customers,” Samsung said in a statement, with a spokesman adding that the order is for network equipment.

However, the company did not reveal whether the contract includes the supply of 5G-capable equipment. Reuters also cites a regulatory filing by Samsung which shows that the period of the contract with Verizon is from June 30, 2020 to Dec. 31, 2025.

“Samsung winning the order from Verizon would help the company expand its telecom equipment business abroad, potentially giving leverage to negotiate with other countries,” Park Sung-soon, an analyst at Cape Investment and Securities, told Reuters following the news.

Shares in the South Korean electronics giant are up 2% in today’s trading, while Verizon is currently trading down 1.5% year-to-date. (See VZ stock analysis on TipRanks).

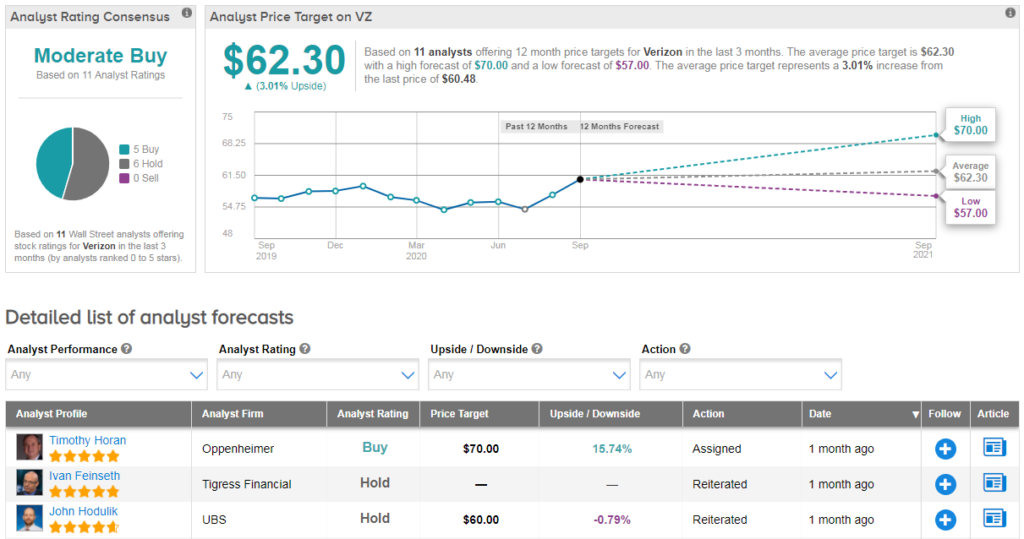

Analysts have a cautiously optimistic Moderate Buy consensus on Verizon stock, with 5 recent buy ratings and 6 hold ratings. Meanwhile the $62 average analyst price target indicates limited upside potential for the coming months.

Back in July, Rosenblatt Securities analyst Ryan Koontz set out his conviction that Samsung was in the final throes of successfully displacing Nokia as a major 5G Radio Access Network (RAN) supplier at Verizon.

“While NOK struggles in 5G over the past 18 months are well-known and SSNLF 5G ambitions have been clear, a major change in 5G RAN suppliers comes as a surprise given the cost of change and strong advantages of incumbent 4G suppliers. We assume SSNLF will have to make incredible price concessions in such a scenario” the analyst wrote.

More recently, Tigress Financial’s Ivan Feinseth reiterated his hold rating on Verizon, arguing that: “While VZ’s current valuation leaves little room for significant upside appreciation, once significant 5G adoption takes place helped by the introduction of new 5G enabled phones, we could see an acceleration of business performance trends in 2021.”

Related News:

AT&T vs Verizon: Which Telecom Giant Has More Upside Potential?

Verizon Boosts Shareholders’ Return With Dividend Hike

Broadcom Down Even As Earnings Impress; Analyst Ramps PT To $390